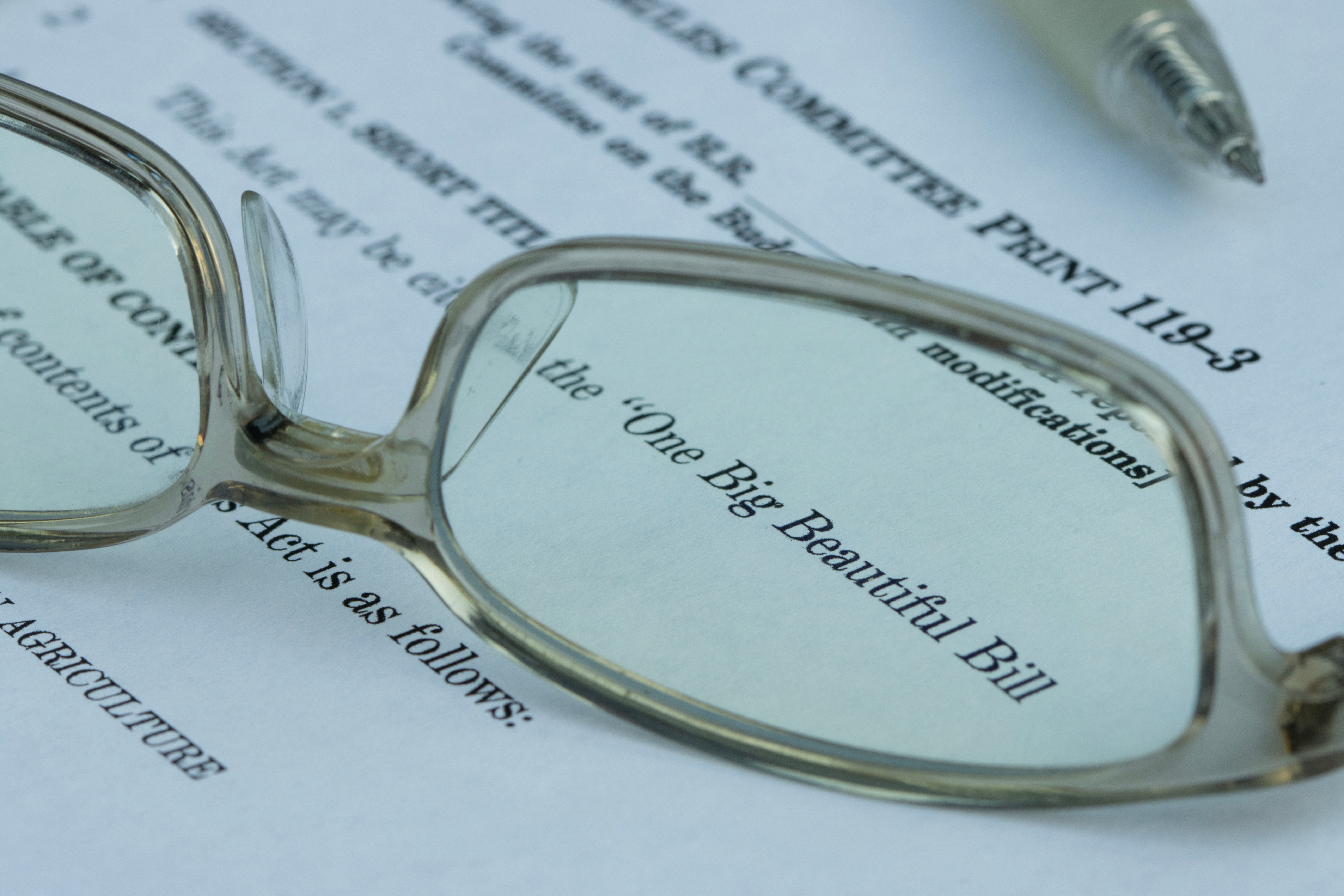

The $4 Trillion Question: What’s Really in the “One Big, Beautiful Bill?”

Authors

- Ylan Mui

- Bryan DeAngelis

This week’s episode of What’s at Stake dives into the details of the "One Big Beautiful Bill Act" and its impact on the national debt and deficits. Marc Goldwein, senior vice president and senior policy director at the Committee for a Responsible Federal Budget, joins hosts Bryan DeAngelis and Ylan Mui to discuss the tax changes, budget gimmicks and long-term fiscal consequences.

Their conversation covered:

- Whether this is really the largest tax cut in history

- Why spending cuts don’t offset the $4 trillion in added debt

- How tariffs, interest rates, and economic growth factor into the administration’s math

- Signals of a potential debt crisis

- If fiscal discipline will ever return to Washington

Transcript

Ylan Mui: 0:06

Welcome to this week's episode of what's at Stake. We're your host, Ylan Mui, Managing Director at Penta.

Bryan DeAngelis: 0:12

And I'm Bryan DeAngelis, Partner and Head of the Washington Office at Penta.

Ylan Mui: 0:16

We're joined today by Mark Goldwein, Senior Vice President and Senior Policy Director for the Committee for a Responsible Federal Budget. Now, I know that you've been super busy lately, given the recent passage of the massive tax and spending package known as the one big, beautiful bill. Mark is here to help explain what exactly is in the bill and its impact on the debt and deficit. Mark, welcome to the podcast.

Marc Goldwein: 0:37

Yeah, thanks so much for having me.

Ylan Mui: 0:39

Let's start with the basics. At its core, this law was supposed to preserve tax cuts for low and and middle-income families that were supposed to expire at the end of this year. President Trump has called this bill the largest tax cut in history. Is it that?

Marc Goldwein: 0:53

Well, it's a quite large tax cut. It's not as big as the Reagan tax cut of 1981, but that was largely reversed. Bottom line is it is a very big tax cut. If you look at the kind of gross tax changes. It's like $5 trillion worth of tax cuts. Now, $4 trillion of that almost is extending tax cuts that were in effect last year and this year and so people might not feel those, but there's another trillion of new tax cuts and between that and the extending of existing tax cuts it's not the biggest in history but it's pretty darn large.

Ylan Mui: 1:26

What are some of those new tax cuts that you were referring to? Is this the no tax on tips?

Marc Goldwein: 1:30

That's right. So it's a mix. So one thing they did is they actually expanded a lot of the 2017 tax cuts. So we used to have a $2,000 child tax credit. Now it's going to be $2,200. They changed the inflation indexing of some of the tax rates in ways that make them more generous. But they also added a number of new tax breaks. There's no tax on tips. These are restricted, so it's actually a tax cut on tips. They call it no tax on tips, A tax cut on overtime pay, An increased deduction, standard deduction for seniors $12,000 for a couple. New tax deductibility for factories. So you know, go build your factory in the next few years. These new Trump accounts, which are kind of like baby bonds you give your, give a kid $1,000 in an account and a bunch of other odds and ends, expansions to the charitable deduction, things like that. Nothing is gigantic by itself, but they do add up.

Bryan DeAngelis: 2:21

He's also called this bill the largest spending cut in history, claiming it cuts about $1.7 trillion. But I think your analysis might say something else. What is your view on it?

Marc Goldwein: 2:32

I mean, it's not even the largest spending cut in the last two years. I guess just barely the last two years, because remember June of two years ago, we had the Fiscal Responsibility Act and with interest that was $2 trillion of spending cuts. Without interest that was $1.5 trillion. This bill is about 1.1 trillion of spending cuts. Don't get me wrong, it's significant spending cuts, but it's not as large as the one two years ago as a share of GDP. It's not as large as some of the other big spending bills you think of, whether it's the Budget Control Act or even the 1997 Budget Deal. And part of the reason it's not so large is that while there's very large cuts to a few programs, it's only a few programs. This bill doesn't touch Social Security. It can't. It doesn't touch Medicare. They're too much of a wimps to do it. It increases defense. It increases farm subsidies.

Ylan Mui: 3:18

It increases spending on border security right.

Marc Goldwein: 3:20

So at the end of the day it is pretty significant Medicaid savings. It is pretty meaningful savings to food stamps and higher education, but in other areas it's actually increasing spending.

Bryan DeAngelis: 3:31

They did cut a few programs that are pretty politically sensitive. They did cut Medicaid and SNAP to fund some of these tax breaks. What did that look like for impact?

Marc Goldwein: 3:44

Yeah, I mean when you say to fund the tax breaks, remember the bill adds $4 trillion to the debt, so the spending cuts didn't actually fund the tax breaks, they just mitigated the cost a little bit. Right, it would have been $6 trillion instead of $4 trillion.

Marc Goldwein: 3:56

But there's a trillion dollars of healthcare savings in this bill which if you had told me we could get a trillion dollars of health savings before, I wouldn't have believed you, and it's coming from all sorts of areas.

Marc Goldwein: 4:06

The one that I think that's gotten the most prominence is these work requirements, which basically say people in Medicare that are of excuse me in Medicaid, that are able-bodied, that are kind of of the right age and are not disabled and don't have young children, they either need to work or do community service or be looking for work for 20 hours a week. That's about a third of the health care savings. Another third is just reversing various Biden administrative actions. President Biden actually expanded Medicaid and the ACA through various administrative actions. The remaining third is largely cutting various loopholes in the Medicaid program where states basically found ways to inflate their matches by kind of colluding with providers. They say we're going to pay you more and tax it back and then we can report a higher bill to the federal government. It restricts us in a lot of ways and so there's also a lot of odds and ends, but those are the kind of the three big buckets of changes.

Bryan DeAngelis: 4:57

Now you mentioned a minute ago this will add $4 trillion to the national debt that goes through 2034. And that could be, I think, as high as $5 trillion if parts of the law are made permanent. How do you think Trump and Republican lawmakers are going to respond to the criticism about this increase in the debt?

Marc Goldwein: 5:16

Yeah, I mean they've mostly responded by lying right, by coming up with all sorts of excuses for why this doesn't actually add to the debt. Here's what the numbers say. They say that through 2034, which is really nine years it allowed $4.1 trillion to the debt as written. But to get the number that low which is extremely high, by the way that's higher than the CARES Act, the American Rescue Plan, the Inflation Reduction Act, the Bipartisan Infrastructure Bill and the CHIPS Act combined or it's almost as high as those combined and to get it that low they had to rely on having a bunch of things expire after four or five years. If all of these temporary provisions are made permanent, it's five and a half trillion. Now what is the administration saying? They've come up with all sorts of excuses. One is well, most of these are just extending existing tax policy, and so that's free. That's called the current policy gimmick.

Marc Goldwein: 6:04

I can talk in a minute about why that's ridiculous.

Ylan Mui: 6:06

Use gimmick instead of baseline, which is their preferred word.

Marc Goldwein: 6:08

Yeah, I'm sure they would rather use baseline, but they're not using a current policy baseline, you know, because a current policy baseline would say everything that's temporary is permanent. What they want is things that are temporary that will cost more to make permanent. We're going to assume permanent, but things that are temporary that would cost us more to make permanent we're going to keep temporary, right. So they want a heads we win, tails, you lose situation not a current policy baseline. So it's unquestionably a current policy gimmick.

Marc Goldwein: 6:32

The second argument they're making is we're going to have really, really, really strong economic growth.

Marc Goldwein: 6:37

Now, in order to get enough economic growth for this bill to pay for itself, it would probably have to be over three, maybe three and a half percent growth per year, compared to the 1.8% that CBO and the Fed and others are projecting.

Marc Goldwein: 6:51

If you look at nonpartisan estimates out there in fact even really partisan estimates any outside estimate, that's not from within the White House they think this bill maybe is going to increase the total size of the economy by half a percent by the end of the decade, right? So that means it's going to go from 1.8 to 1.85, not to three. We're nowhere near what it would take for this to pay for itself with economic growth. In fact, the Congressional Budget Office looked at the House version and found it's going to cost more on a dynamic basis, because the faster growth will be offset by higher interest rates that it's going to cause. And so that's their second argument. Their third argument is well, we're going to pay for this with things outside the legislation, and here there's a kernel of truth, because they do have a lot of tariffs right, and those tariffs generate real revenue More by August.

Marc Goldwein: 7:37

the 1st, potentially Apparently. We've done the math on this and if all the tariffs currently in effect stay in effect, it'll pay for about half the bill. They think it pays for all the bill. They're using ridiculous numbers.

Marc Goldwein: 7:49

So it brings down to $2 trillion, right, it brings down to about $2 trillion instead of $4 trillion, right, so it'd pay for about half the bill. Now, a concern with that is A a lot of those tariffs have already been ruled illegal by a US trade court. They're still in effect pending appeal, but they've been ruled illegal. If you get rid of those, we're only paying for 15% of it. Problem B is we don't know how sustainable those tariffs are. They're not in legislation. A future administration may not support it.

Marc Goldwein: 8:12

This administration says they're trying to get trade deals which we'll get rid of it. We can expect exemptions, and so we don't know how stable they are. And problem number three which doesn't mean it isn't fiscally meaningful, but it's really important to understand is those tariffs can have some pretty serious negative effects on the economy. What we saw is, after the Liberation Day announcement, both the stock market and other economic indicators went down and interest rates went up, and then they recovered some when he paused those tariffs. But interest rates have remained high, and so if even half of that interest rate increases because of the tariff announcement, that wipes away a quarter of those savings. So those are the kinds of excuses they've used. They've come up with many more, but the tariffs is probably the least dishonest of all of them. The rest are mostly make-believe.

Bryan DeAngelis: 8:57

And even to follow their line of messaging for a second. If tariffs stayed as they are, if we saw significant economic growth and if we saw rates for some reason come down in that environment, would they still be able to get to neutral or even close?

Ylan Mui: 9:15

If the stars align, yeah right, if their stars align. If their stars align, can they get there?

Marc Goldwein: 9:23

So I guess an important context is even if we had done nothing, the debt was already in an unsustainable path.

Marc Goldwein: 9:31

We were already borrowing almost $2 trillion a year. We've debted 100% of GDP, head to 117. Secretary Benson has said he wants deficits to get down to 3% of GDP. I think that's an awesome goal that would put the debt in a really sustainable path. As it is, they're headed to 7%. If everything and the stars aligns, we get really fast growth probably not from this bill, but from like AI revolution and things like that. The tariffs come in and do economic harm, interest rates come down, inflationary pressures go away. If everything really aligns, I could see a deficit of 5.5% of GDP, maybe 5% of GDP, by the end of the decade. That's like the very, very rosy scenario.

Marc Goldwein: 10:10

That's the best case I could also see 9% of GDP, because what you have to remember is that interest rates beget debt and debt begets interest rates. And so there's a risk that we start to enter a debt spiral later in this decade and things run away from us pretty quickly.

Ylan Mui: 10:26

That's what I was going to ask you. Next is sort of what is the consequence of a 9% of GDP debt-to-GDP ratio? Is it collapse in the bond market? We talked about the rosy economic scenario. What keeps you up at night? What's the worst one?

Marc Goldwein: 10:41

Yeah, I've read the saying. It's like falling in love or bankruptcy.

Ylan Mui: 10:47

It.

Marc Goldwein: 10:48

Things are likely to happen slowly. I mean, we've seen interest rates incrementally go up. That means mortgages are more expensive, that means it's harder for businesses to get loans. That means we get less investment, fewer factories maybe partially offset by the factory deduction few act fast, less equipment, less software, less innovation and that just means slower economic growth. And so I think kind of the first effect is we're just going to see our growth incrementally slower, already seeing that we're going to see our cost of living incrementally increase with these interest rates, and we're already seeing that and we're going to see our federal interest payments explode.

Marc Goldwein: 11:21

Interest this year is likely to reach a trillion dollars. We now spend more in interest than on Medicare or defense. It's our second largest budget item. I mean, think about it this way we are spending more servicing our past than defending our country. We spend more servicing our past than, in fact, all spending on children.

Marc Goldwein: 11:37

So I think those are actually those sound scary. Those are the incremental consequences, right, the big risk comes when we go from incremental to you know that crisis scenario. And I think that could happen if we start to have one of these debt spirals where higher interest rates push up the debt, push up the higher interest rates and the markets look forward and they say, oof, we're a few years away from things really spinning out of control, from not unsustainable growth in our debt, but exponential growth in our debt. And at that point they're still going to invest in America because we're the greatest economy in the history of the known universe, but they're going to expect a higher interest rate and if that happens, very quickly, all the outstanding bond there's like $15 trillion of bonds that are backing up the global financial system all of it becomes worth a lot less and you could see mass sell-offs.

Marc Goldwein: 12:21

You could see a banking crisis, global financial crisis. Maybe the Fed steps in and buys it and then we just have an inflation crisis, just an inflation crisis. But if they don't, you could see something like and perhaps even if they do, you could see something like the 2007-2009 scenario. Except we can't bail ourselves out, right? Who's going to bail out? The US federal government? It's not going to be the IMF. We've been pretty mean to them recently.

Ylan Mui: 12:43

It's not going to be.

Marc Goldwein: 12:45

Canada.

Ylan Mui: 12:47

We've been mean to them too. I know that you're not a monetary economist, but certainly the Fed has become the political scapegoat for some of the concerns about the debt and about the deficit, and the White House has called on the Fed chair, jerome Powell, to just cut interest rates in order to mitigate this potential interest debt spiral that you're talking about. So it seems unlikely that Powell would bend the knee on that particular front, but he may not be the Fed chair for that much longer.

Marc Goldwein: 13:20

Yeah, I mean. I think there's two questions to my mind. The one is will the Fed cut interest rates to help with the fiscal situation? That's called fiscal dominance, and the second is could they? And what I mean by the could they is last time the Federal Reserve cut rates by 1%, which was last year, the 10-year Treasury bonds went up by almost 1%, right.

Ylan Mui: 13:41

They lost control of the yield curve yeah.

Marc Goldwein: 13:43

Right. So what you do with the short-term rates, what you do with what you're paying on the reserves and the discount window and things like that doesn't necessarily affect the long-term bond yields in the way that you might hope.

Marc Goldwein: 13:54

Now they could maybe just step in and buy those long-term bonds, but the Fed is already losing quite a bit of money, and so I think that would get difficult. So there's a question of if the Fed even has that much control at this point over our interest rates. But then there's the second question of would they and I don't think this Federal Reserve or any near-term any Federal Reserve I can imagine, even if with new appointees would go as far as sort of explicit fiscal dominance, where they are explicitly cutting rates just to stabilize the bond market, and the bond market is destabilized because of our debt, right? And so even if it's not fiscal dominance, in fact it is as a practical matter. And I do think that's a risk, because once the Fed is in that business, not for just emergency rescue but for ordinary stuff you can get to a kind of a Japan-type scenario where our financial systems really become very undynamic.

Bryan DeAngelis: 14:55

So, building on that for a moment, what will you be looking at over the next few months, or maybe longer, and maybe for our listeners, what are some of the signs in the economy they should be looking at to see if we are heading towards this more? Forgive me, but doomsday scenario.

Marc Goldwein: 15:19

Yeah. So I think that the near-term challenge isn't the debt crisis, it's the stagflation crisis, right? So the first thing I'm looking at is are we headed towards stagflation? And it doesn't seem like we're there now, but there's a lot of risks that make it particularly high. Right, we've had a long period of time of inflation.

Marc Goldwein: 15:30

The Fed has kept rates very high at the same time that we are creating new supply shocks, like tariffs, like deportations, closing the border, reductions of the federal workforce that are kind of focused on government production more than transfers. These things are all causing supply shocks and if it happens in the wrong way, you could see a stagflation scenario and that could spark a debt crisis, because in a stagflation scenario, the Fed has extra pressure to keep rates high. But if they do, we're deep in a recession. If they don't, we're deep in inflation. Either way, the bond markets may not be happy. So that's what I'm looking for.

Marc Goldwein: 16:06

Number one. Number two what I'm looking at is just overall, the Treasury yields. I mean, there's a lot of complicated measures we can look at, like the tail ends and the auctions and stuff like that, but like watch the yields and like there's gonna be day-to-day and week-to-week volatility, but what's the overall tenor? Are the markets kind of breathing a sigh of relief because this is pretty much what was expected we actually did better on spending cuts than they thought and inflation seems to be moderating or are they holding their breath because it feels like this is just the beginning and, uh, we've opened up a whole new set of budget gimmicks that future administrations are going to use for all sorts of hijinks that are going to take the debt from bad to worse let's uh.

Bryan DeAngelis: 16:46

That's where I wanted to kind of go. Next, it seems like both political parties have just given up on fiscal responsibility. I mean, I feel like Republicans get religion on this every time they're in the minority, but it quickly kind of goes out the window and Democrats are moving even more towards a kind of massive spending, you know, big government sort of approach. So I mean, as you're watching this and watching budget norms, I mean, do you see any hope for kind of fiscal responsibility?

Marc Goldwein: 17:17

coming back to our politicians, Well, I have to hope right. Because, I don't know what else to do.

Ylan Mui: 17:24

There's got to be a road out.

Marc Goldwein: 17:26

I will say the last few months kind of goes counter to this, but it did seem like we were at peak irresponsibility around 2021, and we were starting to come back down to earth, right. It seemed like there was a period of time from 2015 to 2021, where each subsequent legislation just was worse than the last one and each subsequent budget norm was broken and partially driven by very low interest rates. Neither party seemed to care at all. And then in 2021, budget constraints started to return. It returned with the failure of the Build Back Better Act and it's turned into the Inflation Reduction Act that was actually scored as deficit-reducing. What we know now is it was probably a very modest deficit increase there, but that's not really the point. The point is that politicians reacted to the situation and scaled back. They had a $3 trillion bill and they ended up with a bill that, let's say, was $100 billion Even if I'm wrong, it was $300 billion, it's still only a tenth of it.

Marc Goldwein: 18:23

And then they came next and Republicans took power and they didn't demand like we're going to end the public health emergency or whatever the debt limit. We're going to stop a woke government. They demanded spending caps, right, and so what we actually saw in 2022 and 2023 was a move towards fiscal responsibility, and now we've seen this move back. But Even in this move back, no one's making the MMT arguments of the right. They're not saying, well, we can borrow as much as we want. What they're saying is, no, actually we're not borrowing, right, yes, which one is a more dangerous argument?

Marc Goldwein: 18:50

It's fair, but they're definitely feeling the pressure and they got big spending cuts. I don't think we should ignore that. There's big spending cuts in this bill.

Marc Goldwein: 18:57

That's fair, even though, from from my perspective, this bill is hugely irresponsible. It could have been way, way more irresponsible. I think what President Trump wanted to do, based on his campaign promises, was basically come in and just do the tax cuts. Right. I think that actually a lot of most of many in Congress just want to do the tax cuts and then talk about the spending later. But they included about $2 trillion of offsets between the spending cuts and various revenue increases, so I think they do care at least a little bit. The problem is they don't care enough to not add $4 trillion to the debt, and if each time, they don't care enough to not add $4 trillion to the debt, we're in.

Bryan DeAngelis: 19:32

I don't know if we're allowed to curse in this podcast. Sure, it gets us more viewers. We're in big trouble. We're in big trouble.

Ylan Mui: 19:40

Well, I wonder what you think a potential solution could be or if you guys have put much thought into that. I think there is some buzz again about fiscal commissions and budgetary oversight et cetera. Do you think any of that is real or helpful? What is the road out?

Marc Goldwein: 19:58

Yeah, so the last remaining budget rule that we have. We used to be a country governed by budget rules and norms, right, and the norms were you've got to balance the budget, but the rules were you have your pay goes, you've got to pay for new things, and you have discretionary caps, and you have your reconciliation that's for deficit reduction and things, and you've got your debt limit that, even though you don't abide by it, you use it as an opportunity for deficit reduction. Most of those are gone, but the one that's left is the trust funds. You know, social Security is still a completely self-financed program with very little cheating. Medicare and highway similarly so, and so I think those are the next big opportunities is 2032, both the Social Security and Medicare trust funds are going to run out of money. That doesn't mean that the programs disappear, but it does mean they have a massive funding gap and that's an opportunity to make some serious reforms and I hope we can act in advance rather than waiting until, like, december 1st of 2032. But my money's on December 1st of 2032.

Ylan Mui: 20:52

December 1st, you'll probably be lucky not.

Marc Goldwein: 20:54

December 31st. Well, it's not going to make it to December 31st by our projections, but those projections will change. But, yeah, probably they'll find a way to kick to the end of the year. But I think that's the next big opportunity. I hope we can get something before then. It's such a mess, but I think that the trust fund insolvency really is going to bring people's attention to this issue.

Bryan DeAngelis: 21:12

Do you think it'll bring bipartisan attention? Do you think, to Alon's point, it will bring back? Those glory days of bipartisan commissions. I don't know if we're bringing back the glory days.

Marc Goldwein: 21:20

I don't know if we're bringing back the glory days. I think a commission is possible, especially because, if you're asking me to play a scenario plan, my best guess is the old age program runs out in 2032. The disability fund has more time. My guess is, at the end of 2032, they come in and they say okay, we're going to let the bar from the disability fund, which gives us another year or two, and we're going to establish a commission so we can figure it out by then. Now do they actually figure it out? That's I don't know, but I think that's what they're going to try to do and so I hope. So I hope there's an opportunity. You know, we work with bipartisan folks in the House and when it's not, these big partisan moments like reconciliation, like the beginning of a new administration, like an election which I know that's like 80% of the time, but like the other 20% of the time, they really are trying to work together and come up with solutions.

Bryan DeAngelis: 22:02

Going back to your point about, we seem to be heading in the right direction in terms of fiscal I won't say fiscal responsibility, but people being concerned about fiscal responsibility and then that kind of going out the window a little bit at this big moment. Do you think that changes with a different administration? Let's assume for a second this is Trump's last term and, given his influence, over the party, if it's someone less powerful than that.

Marc Goldwein: 22:31

I do think President Trump is very unique for any politician. I think we all know he's unique. He would say that, but he's not like other Republicans. Right, and other Republicans add to the debt plenty. Right, They've supported tax cuts and they've supported defense increases, but they haven't been so enthusiastic about it as President Trump was in his first term. Right, They've been more constrained and they've also focused more on deficit reduction, whereas President Trump said I'm not touching Social Security, I'm not touching Medicare. He also said he didn't touch Medicaid, which is only a trillion dollars away from true right.

Ylan Mui: 23:03

But um right, so the question.

Marc Goldwein: 23:05

The question is like when he's gone, does some remnants of the old party come back, or has he transformed the party forever? And that's I mean. You know, that's the fortune.

Bryan DeAngelis: 23:15

Another question going forward yeah, but even his influence on that party, I mean it, it. I'm surprised this bill has been signed. You know, the congress, I know, would have continued to fight. We would have seen the Freedom Caucus hold it up a little bit more, and he really knows how to pull them all in line.

Marc Goldwein: 23:30

It's actually quite amazing, not only that he got it to the finish line, but that he got it by his deadline right.

Ylan Mui: 23:35

Yes, exactly that was what was really amazing. Time to the flyover over the White House.

Marc Goldwein: 23:40

It wasn't even you are going to get to yes because the president is telling you it was. You are going to get to yes by this day, right, and that is pretty amazing, because the House you know again even the.

Marc Goldwein: 23:50

House version of the bill was not good, but it was significantly better. I mean, the House really got the cost down and I wouldn't say they completely rolled over. I mean the Senate bill did take a lot of what the House did, but in the 11th hour they did roll over and they accepted an extra $600 billion in excess of what they had said was their red line.

Bryan DeAngelis: 24:13

And they didn't even fight it particularly hard. I'm an old Senate guy so I think that happens a lot.

Ylan Mui: 24:15

I mean, it was incredible, we were having informal pools in the office of when was the real date going to be? Is it going to be August, is it going to be when we hit the debt limit, et cetera, and so Christmas.

Ylan Mui: 24:26

Eve, December 31st, speaking of right. So I think we were all. I mean, I think toward the end it was kind of clear that they were going to be coming up on deadline that Trump had put out. But you know, when this first started, we all assumed it would take the full course of the year.

Bryan DeAngelis: 24:42

Mark, fascinating conversation. Thanks again for joining us on today's episode For our listeners. You can find more of Mark's insights on fiscal and economic policy on X. Follow him at Mark Goldwine and to our listeners, remember to like and subscribe wherever you listen to your podcasts. And follow us on X at PentaGRP and on LinkedIn at PentaGroup. We're your hosts, brian.

Ylan Mui: 25:06

And Ylan. As always, thanks for listening to What's at Stake.