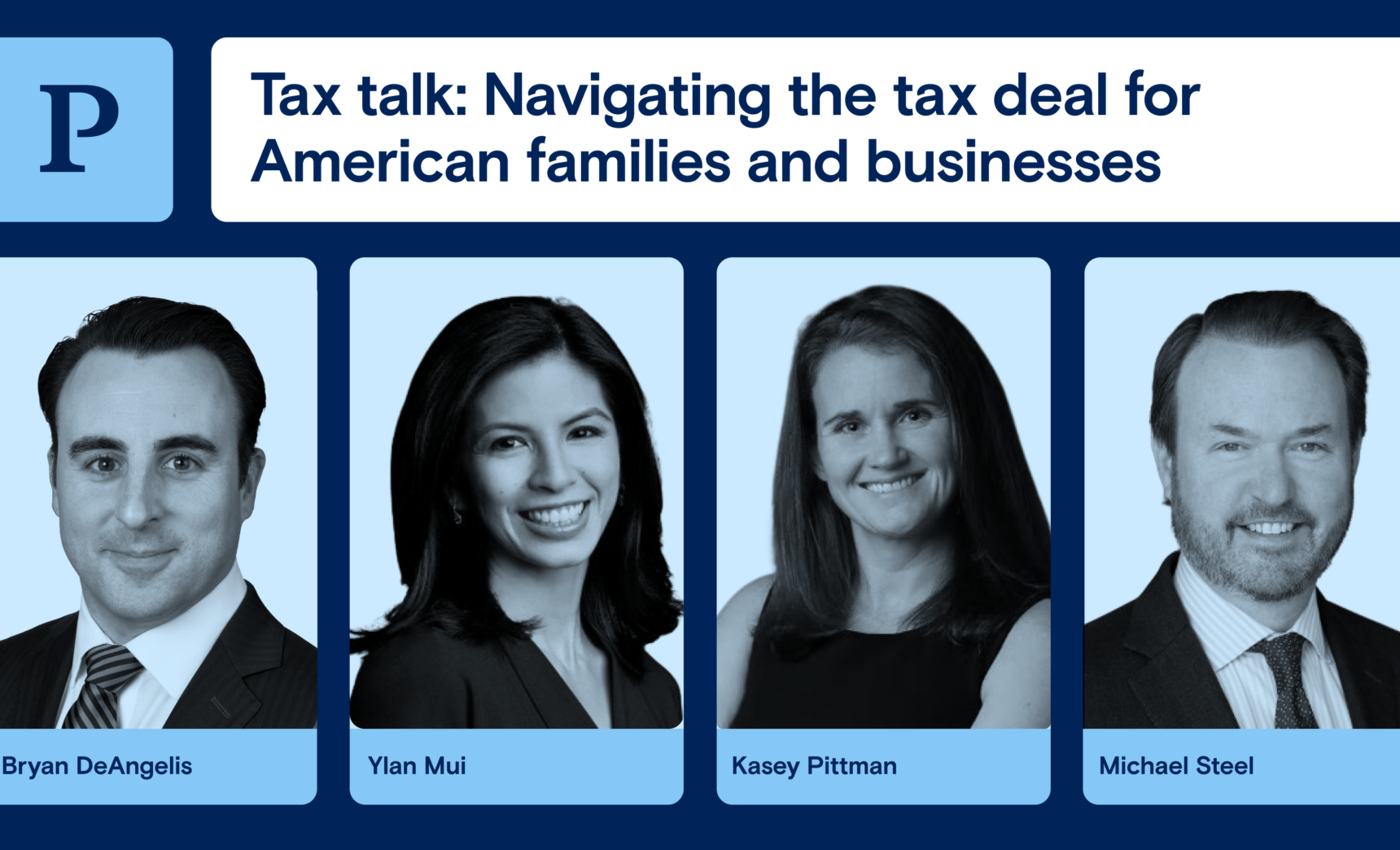

On this week's episode of What's at Stake, Penta Partner Bryan DeAngelis and Managing Director Ylan Mui explore the implications of the Tax Relief for American Families and Workers Act with expert insights from guests Michael Steel, senior vice president of Communications at Business Roundtable and Kasey Pittman, a director with Baker Tilly’s Washington national tax practice. They offer analysis on critical updates to business tax provisions, highlighting potential impacts on low-income families and business owners nationwide.

The group touches on the changing U.S. business environment with a focus on small businesses and startups, assessing how updates to R&D tax credits, business interest deductions, and bonus depreciation could affect cash flows and innovation investments. Looking forward, they examine the dynamics of tax policies amidst global competition and a divided government. Discussing the potential for tax code revisions post-2024 elections, they also analyze the expiration of key provisions and the political strategies shaping the economic landscape. Tune in for a thoughtful exploration of the intersection between political decision-making, financial accountability, and the real-world impact on American businesses and families.