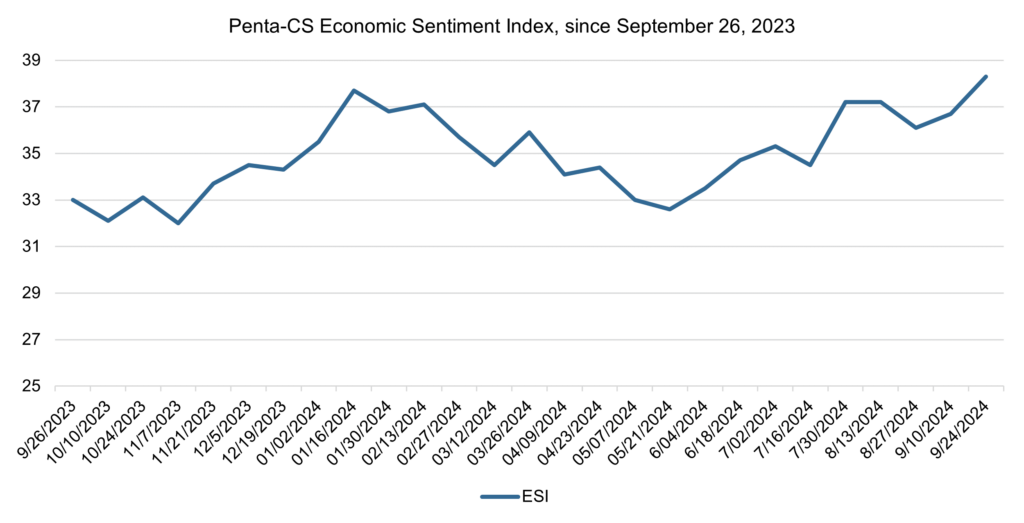

The latest biweekly reading of the Penta-CivicScience Economic Sentiment Index (ESI) increased by 1.6 points to 38.3, a notable improvement in confidence over the past two weeks following the Federal Reserve’s decision to cut interest rates by 50 basis points at its September meeting.

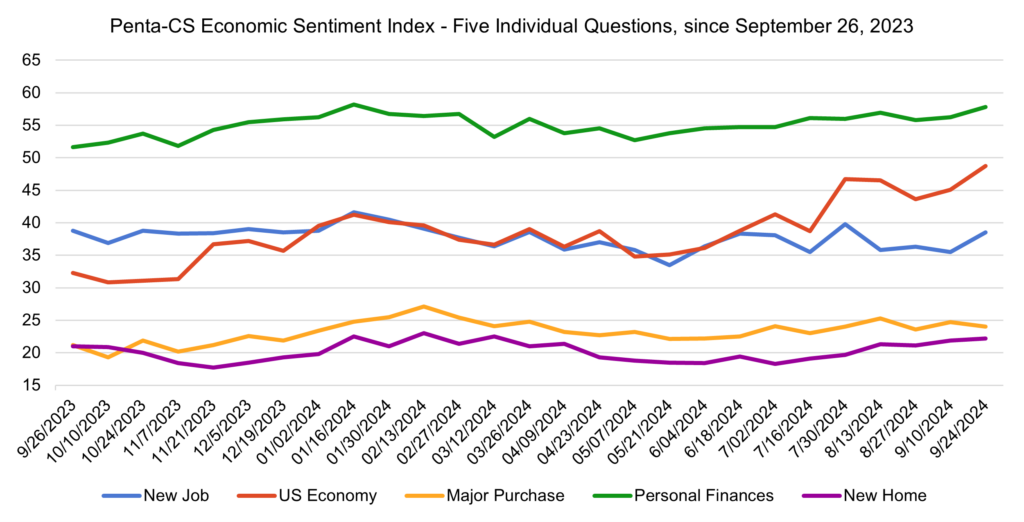

Four of the ESI’s five indicators increased during this period. Confidence in the overall U.S. economy saw the largest gain, rising 3.6 points to 48.7.

—Confidence in finding a new job increased 3.0 points to 38.5.

—Confidence in personal finances increased 1.6 points to 57.8.

—Confidence in buying a new home increased 0.3 points to 22.2.

—Confidence in making a major purchase decreased 0.7 points to 24.0.

The Federal Reserve cut interest rates by 50 basis points to between 4.75 percent and 5 percent, the first rate cut since March 2020. This move came amidst slowing job growth and a steadying rate of inflation. In its Federal Open Markets Committee statement, the Fed stated that this move “seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run.” Fed Chair Jerome Powell stated similarly, emphasizing that the Fed is “trying to achieve a situation where we restore price stability without the kind of painful increase in unemployment that has come sometimes with this inflation.”

Major stock indexes surged on Thursday, September 19 following the Fed’s announcement to cut rates, with the Dow Jones Industrial Average closing 1.3 percent higher than the previous day and the S&P 500 growing 1.7 percent. These surges caused both the Dow and the S&P to close at record highs.

The Bureau of Labor Statistics released its August Consumer Price Index (CPI) data, showing that the Index excluding volatile food and energy costs rose 0.3 percent and 3.2 percent on an annual basis. Meanwhile, all items increased 2.5 percent on an annual basis, down from 2.9 percent in July. AP reported that this is the fifth consecutive annual drop and the lowest measure since 2021.

Meanwhile, the Commerce Department reported that August retail sales were up 0.1 percent from July and 2.1 percent year over year. This data shows that consumers are still spending despite persistent inflation, though the August pace is much slower than July’s upwardly revised 1.1 percent increase.

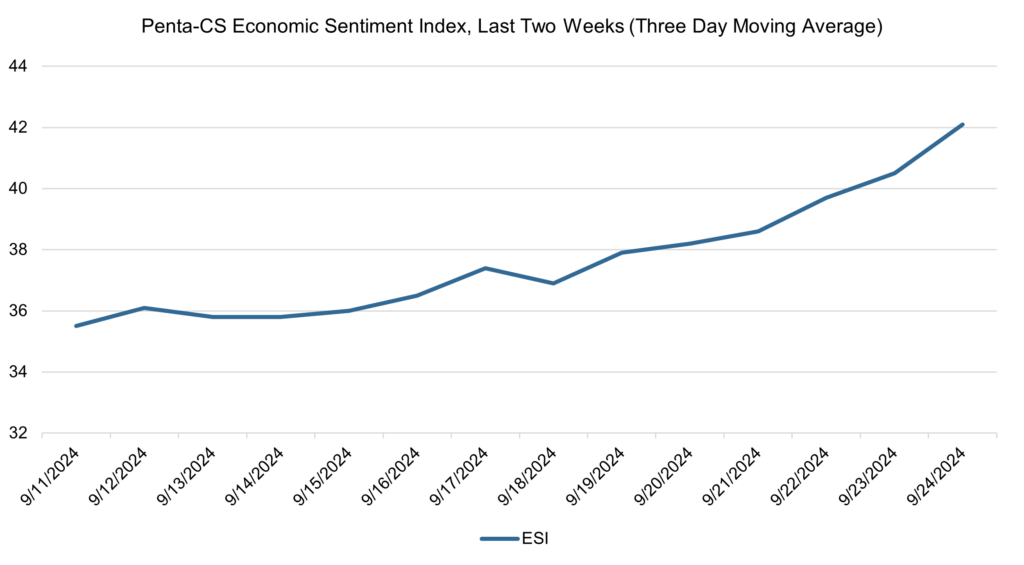

The ESI’s three-day moving average began this two-week stretch at 35.5 before rising to 37.4 on September 17. It then dipped slightly on September 18 before rising again, closing out the period at 42.1 on September 24.

The next release of the ESI will be on Wednesday, October 9, 2024.