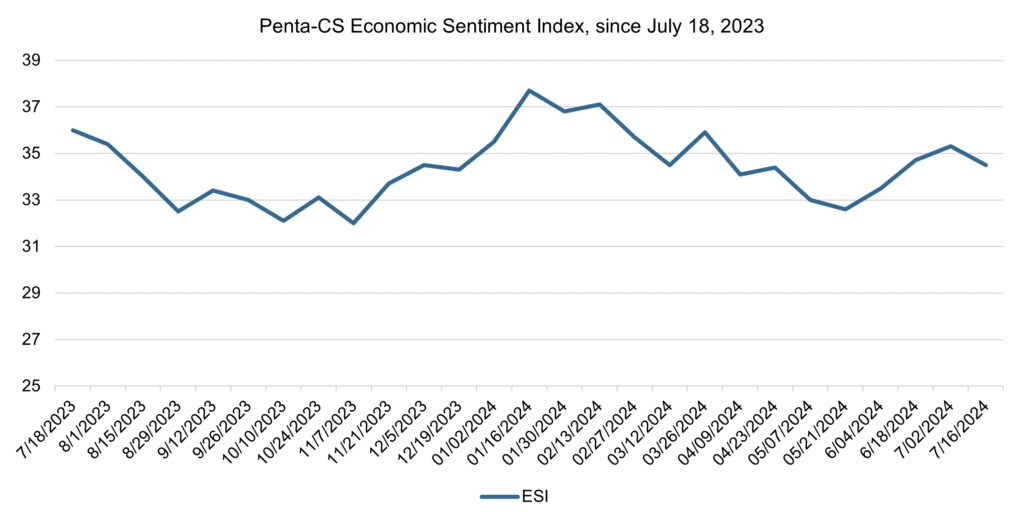

Economic sentiment decreases for the first time since late May

Economic sentiment decreased over the past two weeks, breaking its string of increases observed over the past three periods. The Penta-CivicScience Economic Sentiment Index (ESI) fell 0.8 points to 34.5.

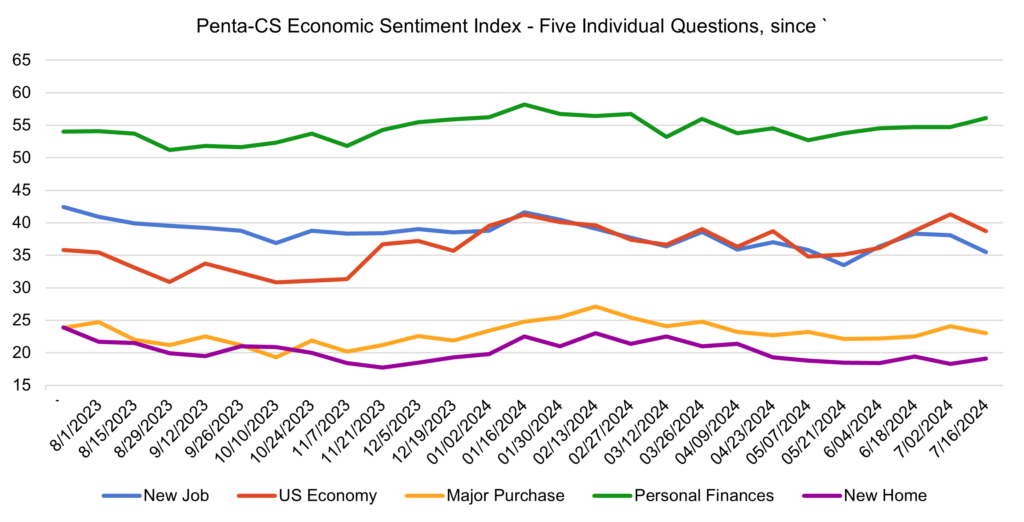

Three of the ESI’s five indicators decreased over the past two weeks. Confidence in finding a new job and confidence in the overall U.S. economy decreased the most, both falling 2.6 points to 35.5 and 38.7, respectively.

—Confidence in making a major purchase decreased 1.1 points to 23.0.

—Confidence in buying a new home increased 0.8 points to 19.1.

—Confidence in personal finances increased 1.4 points to 56.1.

The June jobs report showed the economy added 206,000 jobs, coming in slightly higher than economists’ predictions of 190,000. Meanwhile, the U.S. Department of Labor Statistics reported that the unemployment rate increased by 0.1 percentage points to 4.1 percent. This increase represents the metric’s highest level since November 2021.

Additionally, the U.S. Department of Labor Statistics revised total nonfarm payroll employment from April and May down a combined 111,000 jobs. J.P. Morgan reported that this revision decreased the three-month average payroll gains to 177,000, marking the slowest pace since January 2021.

In his recent testimony before the House Financial Services Committee, Fed Chair Jerome Powell indicated that rate cuts may come before inflation decreases to 2%. Powell stated “We’re not just an inflation-targeting central bank” and that the Fed is also watching other economic indicators, specifically the slowing labor market, when considering cuts. Powell warned that rate cuts that come “too late or too little could unduly weaken economic activity and employment.”

The U.S. Bureau of Labor Statistics released its June Consumer Price Index (CPI) data, showing that the Index excluding food and energy costs also rose 0.1% in June and 3.3% on an annual basis. The Bureau stated that this marks the core rate’s smallest 12-month increase since April 2021. Meanwhile, the all items index increased 3.0% over the last 12 months.

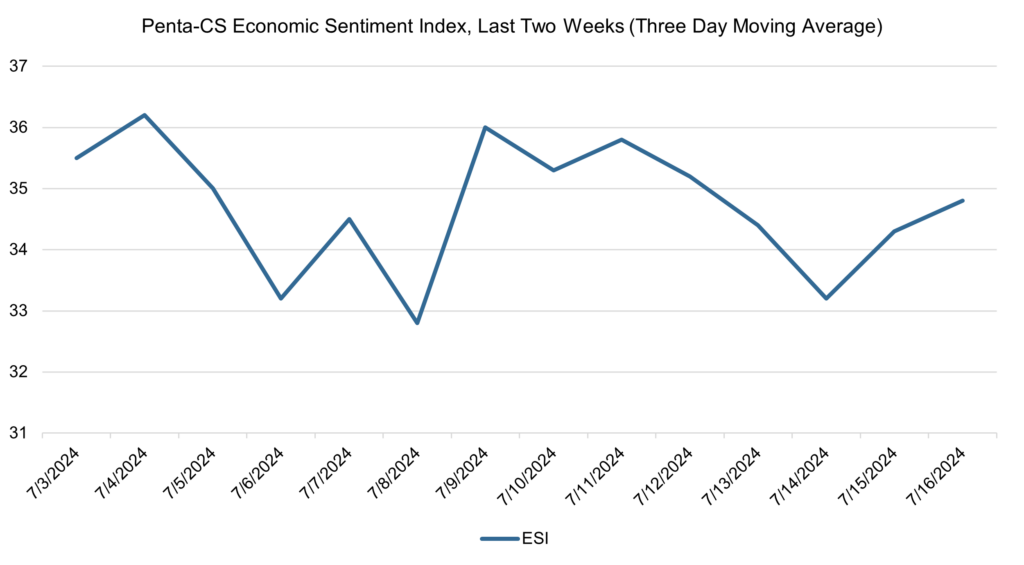

The ESI’s three-day moving average began this two-week stretch at 35.5 on July 3. It then increased to a peak of 36.2 on July 4 before sharply decreasing to 33.2 on July 6. The three-day moving average then rose back up to 34.5 on July 7 before falling to a low of 32.8 on July 8. It then increased back up to 36.0 on July 9, then oscillated slightly before falling to 33.2 on July 14. The moving average then rose back up to 34.8 on July 16 to close out the session.

The next release of the ESI will be Wednesday, July 31, 2024.