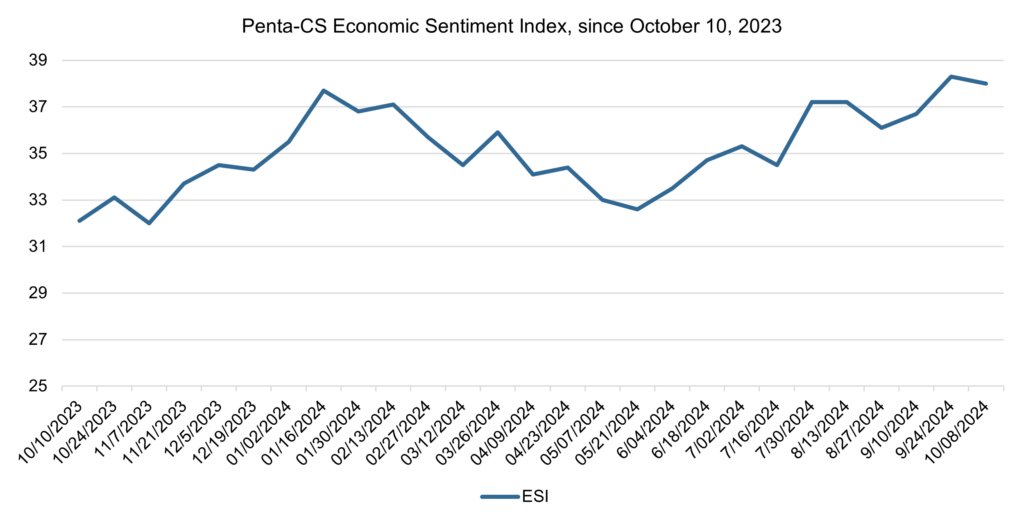

The latest biweekly reading of the Penta-CivicScience Economic Sentiment Index (ESI) decreased by 0.3 points to 38.0, marking a slight dip in overall economic confidence over the past two weeks.

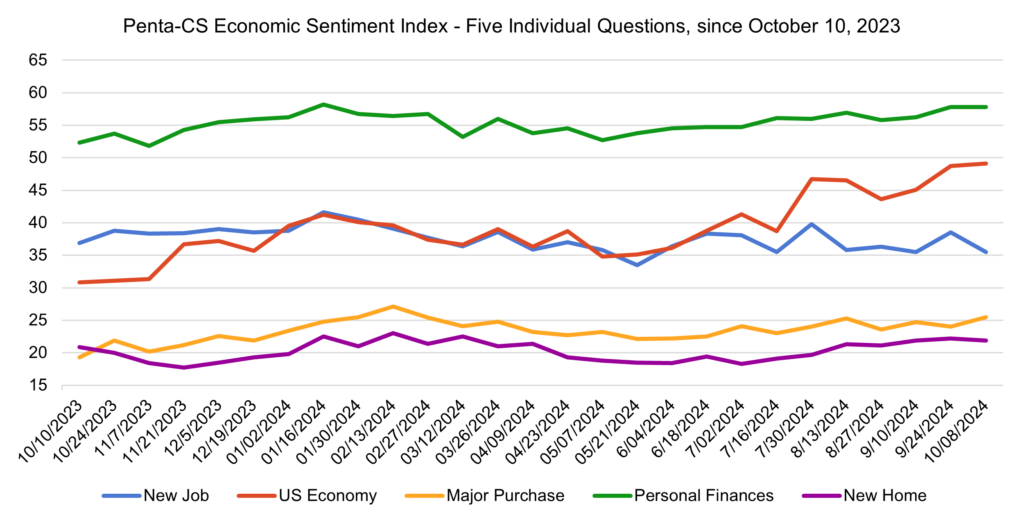

Two of the ESI’s five indicators decreased during this period. Confidence in finding a new job fell the most, dropping 3.0 points to 35.5.

—Confidence in buying a new home decreased 0.3 points to 21.9.

—Confidence in personal finances remained flat at 57.8.

—Confidence in the overall U.S. economy increased 0.4 points to 49.1.

—Confidence in making a major purchase increased 1.5 points to 25.5.

The September Jobs Report from the Bureau of Labor Statistics revealed that nonfarm payroll employment increased by 254,000 during the month, the largest job gain in six months. The unemployment rate also fell to 4.1%, and July and August data were revised upward by 72,000 combined. These data came on the heels of a substantial 50 basis point cut in interest rates in September, pointing to greater resiliency in the macroeconomy than initially anticipated.

Data from the Bureau of Economic Analysis showed that the core personal consumption expenditures index (core PCE), which excludes volatile food and energy prices, increased slightly in August, rising 0.1 percentage points to 2.7% year-over-year. This data reflects continued progress toward steadying inflation near the Federal Reserve’s 2% target.

Revised data from the Bureau of Economic Analysis shed new light on the strength of the economic recovery following the pandemic. Updated estimates of the U.S. gross domestic product (GDP) show that the economy grew faster in 2021, 2022, and early 2023 than previously reported. Notably, the revised data indicates that GDP grew slightly in the second quarter of 2022, contradicting earlier reports of two consecutive quarters of negative growth, which would have potentially suggested a recession.

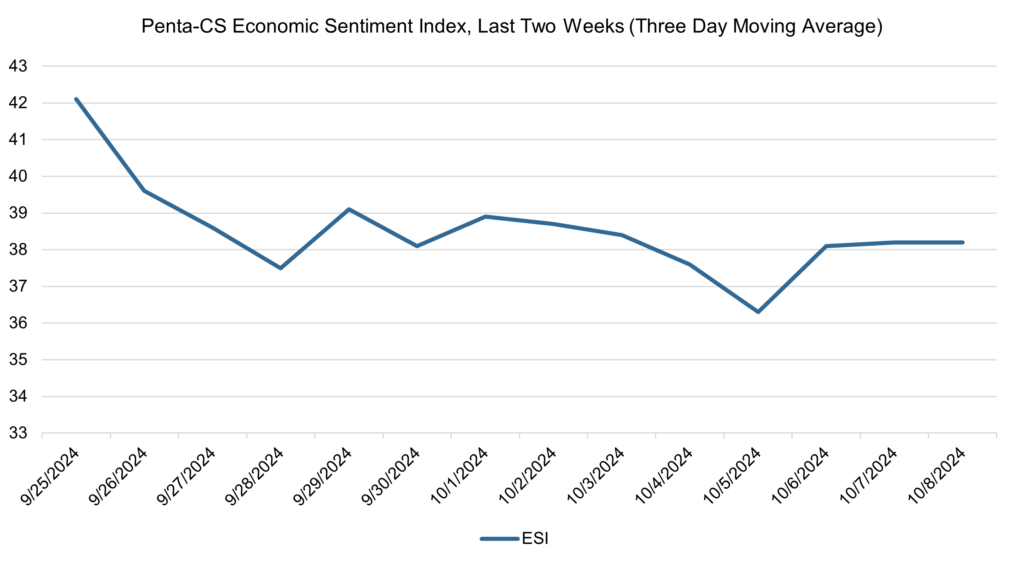

The ESI’s three-day moving average began this two-week stretch at a high of 42.1 on September 25 before falling to 38.1 on September 28. It then fluctuated before dropping to a low of 36.3 on October 5. The three-day moving average then rose up to 38.2 to close out the session on October 8.

The next release of the ESI will be on Wednesday, October 23, 2024.