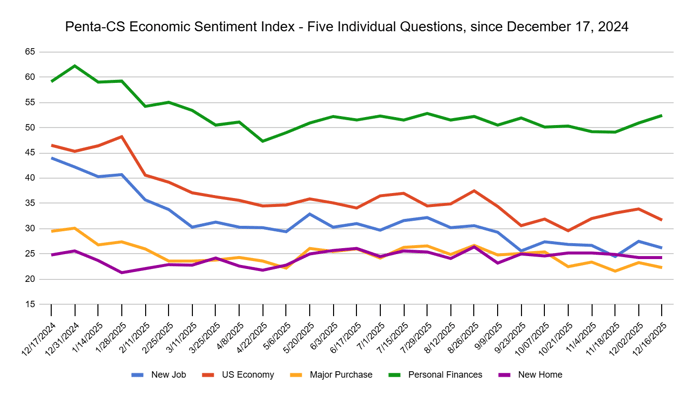

Three of the ESI's five indicators decreased during this period. Confidence in the overall U.S. economy decreased the most, falling 2.2 points to 31.7.

—Confidence in finding a new job decreased 1.3 points to 26.2.

—Confidence in making a major purchase decreased 1.0 point to 22.3.

—Confidence in buying a new home remained at 24.3.

—Confidence in personal finances increased 1.5 points to 52.4.

At its December meeting, the Federal Reserve delivered a widely expected "hawkish cut," lowering the federal funds target range rate by a quarter percentage point to a 3.5–3.75 percent range, despite divisions emerging over the path ahead. The decision was approved by the Federal Open Markets Committee (FOMC) in a rare 9–3 vote. Additionally, the committee's updated dot plot, a chart showing where each FOMC participant expects interest rates to be in the future, signaled only one additional cut in 2026 and another in 2027. Fed Chair Jerome Powell emphasized that policymakers are, "well positioned to wait and see how the economy evolves". Beyond the rate move, the Fed also announced it will resume Treasury purchases, beginning with $40 billion in T-bills this week, as officials navigate persistent inflation, mixed labor-market signals, and political scrutiny ahead of Powell's term ending next year.

The FOMC stated that recent data shows the economy expanding at a moderate but slowing pace, with job gains weakening and unemployment edging higher through the fall. Inflation has continued to increase throughout the year and remains "somewhat elevated." Uncertainty about the economic outlook is also elevated. Lastly, Fed officials noted that the risks to the job market are growing, meaning they're now more worried about rising unemployment, reflecting softer hiring and early signs of labor-market cooling as businesses grow more cautious.

The release of the delayed November jobs report showed a fragile labor market, with payrolls rising just 64,000 in November after a steep 105,000 decline in October. Unemployment climbed to 4.6 percent, its highest level in four years. November's gains were narrowly concentrated — health care accounted for more than 70 percent of net job growth — while sectors such as transportation continued to shed workers. Average hourly earnings rose only 0.1 percent, reinforcing that wage pressures are not fueling inflation.

Additionally, the U.S. Census Bureau's advance estimates for October showed retail and food services sales were essentially flat at $732.6 billion, though still 3.5 percent higher than a year ago, with gains driven largely by nonstore retailers and steady growth in food services.

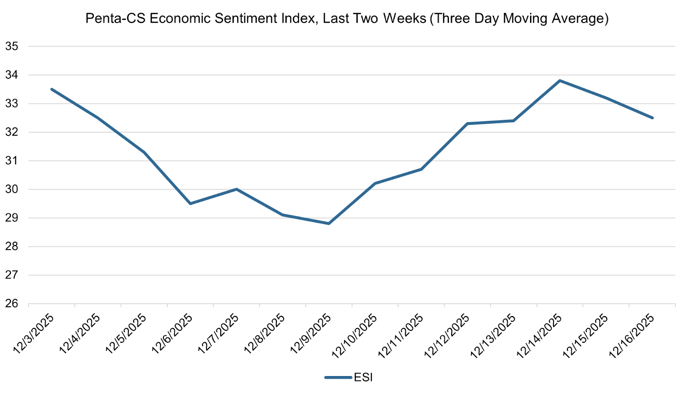

The ESI's three-day moving average began this two-week stretch at 33.5 on December 3. It then decreased, falling to a low of 28.8 on December 9. The three-day moving average then steadily increased to a high of 33.8 on December 14 before decreasing to 32.5 on December 16 to close out the session.

Due to the New Year's holiday, the next release of the ESI will be on Wednesday, January 14, 2026.