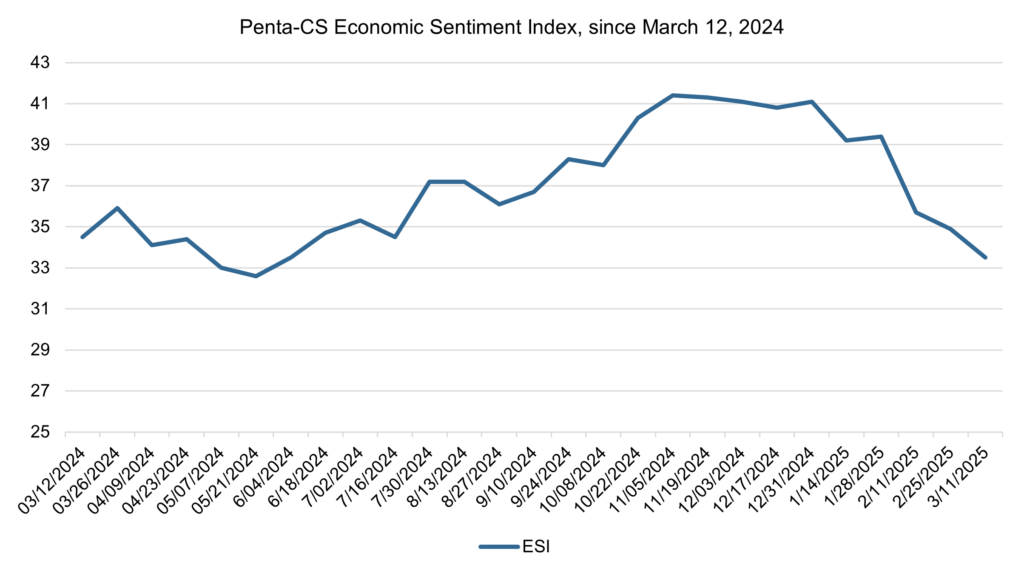

The latest biweekly reading of the Penta-CivicScience Economic Sentiment Index (ESI) fell sharply by 1.4 points to 33.5, further deepening the ongoing downturn in consumer sentiment this year.

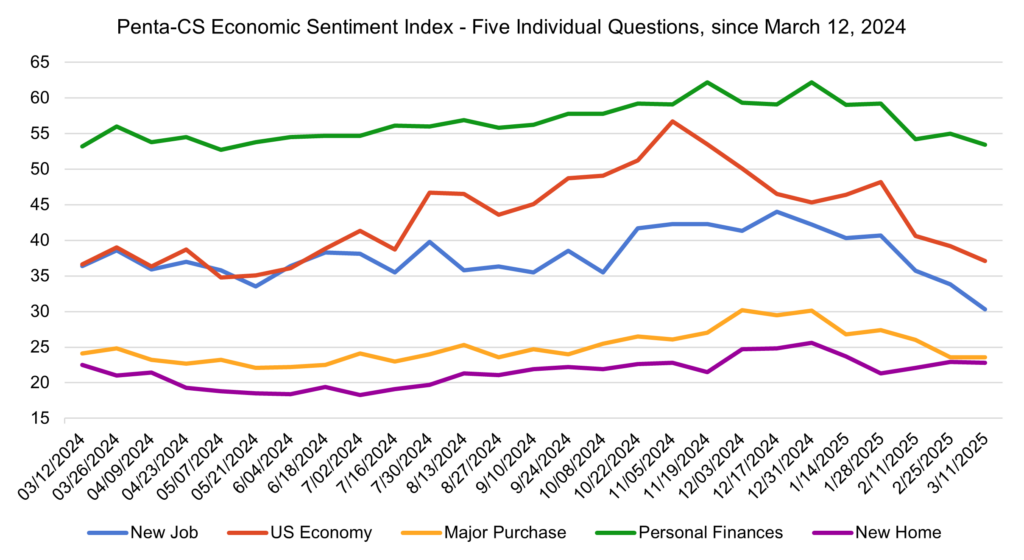

Four of the ESI’s five indicators decreased during this two-week period. Confidence in finding a new job decreased the most, falling 3.5 points to 30.3.

—Confidence in the overall U.S. economy decreased 2.1 points to 37.1.

—Confidence in personal finances decreased 1.6 points to 53.4.

—Confidence in buying a new home decreased 0.1 points to 22.8.

—Confidence in making a major purchase remained unchanged at 23.6.

On March 3, President Donald Trump announced a 25 percent tariff on imports from Canada and Mexico, citing concerns over fentanyl trafficking and unauthorized immigration. This action prompted retaliatory tariffs from both countries. The president granted a one-month exemption to tariffs affecting the Big Three U.S. automakers—Ford, General Motors, and Stellantis—on March 5 and then a wider postponement of tariffs on imports from the U.S.’s neighbors on March 6.

Later on March 11, President Trump announced that the U.S. would be raising tariffs on steel and aluminum imports from Canada to 50 percent beginning March 12. This would have been in addition to previously planned 25 percent tariffs on steel and aluminum imports from all countries. However, the president reversed course later that day after Ontario agreed to halt its 25 percent export tax on electricity coming into Michigan, Minnesota, and New York. The original 25 percent tariff on steel and aluminum imports did, however, go into effect.

The stock market has reacted negatively to these shifting U.S. tariff policies. By March 10, the S&P 500 had wiped all gains made since November 2024. Stocks slipped further on March 11, with the S&P 500 index falling by 0.76 percent, and the Nasdaq composite index dropping 0.18 percent, underscoring investor concerns about potential economic disruptions resulting from trade disputes.

The Federal Reserve Bank of Atlanta’s GDPNow estimate, a preliminary, real-time model that provides a running estimate of the current quarter’s growth in economic output based on available economic data, projected a slowdown in the U.S. economy for the first time this quarter on February 28. The model’s estimate for annualized gross domestic product (GDP) growth predicted a contraction of -1.5 percent on February 28, reflecting weaker-than-expected trade and consumer spending data. The estimate has since decreased further to -2.4 percent on March 6. If these estimates for negative GDP growth come to pass, it would be the first quarterly contraction of the U.S. economy since early 2022. In the wake of these data and broader economic uncertainty, President Trump declined to rule out a recession in 2025, telling Fox News’ Maria Bartiromo, “I hate to predict things like that. There is a period of transition because what we’re doing is very big. We’re bringing wealth back to America. That’s a big thing… it takes a little time, but I think it should be great for us.”

The U.S. Bureau of Labor Statistics’ February Jobs Report reported that U.S. employers added 151,000 jobs last month, coming in slightly below economists’ expectations. The unemployment rate ticked upward slightly from 4.0 percent to 4.1 percent. Federal government jobs declined by 10,000 since the previous month, likely due to the federal hiring freeze. This reflects the first decline in federal employment since June 2022. Some analysts have noted, however, that job losses from the Trump administration’s efforts to reduce the federal workforce are not yet accounted for in the jobs report.

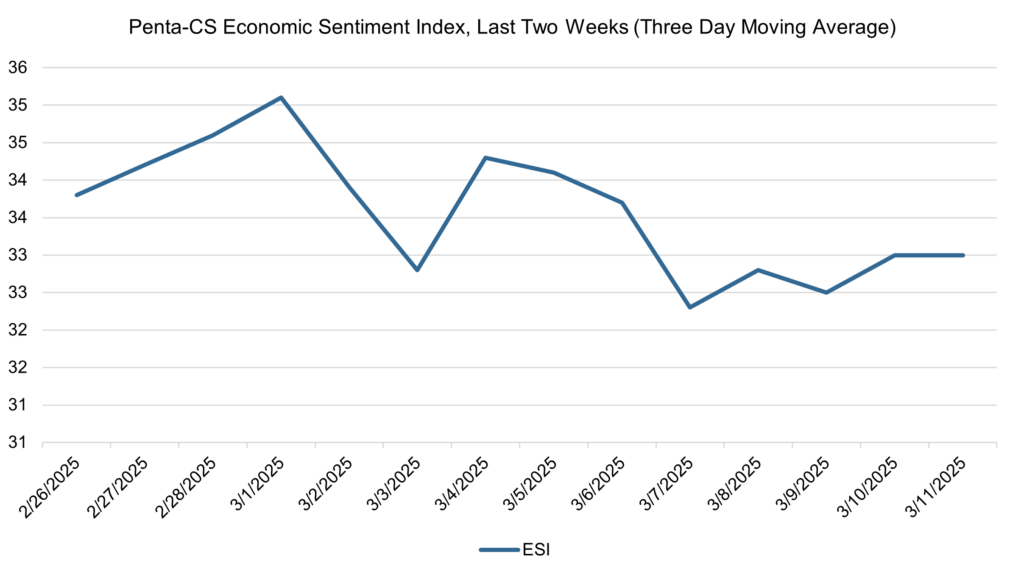

The ESI’s three-day moving average began this two-week stretch at 33.8 on February 26. It then rose slightly, hitting a high of 35.1 on March 1 before trending downward to 32.8 on March 3. The three-day moving average then rose back up to 34.3 on March 4 before falling again to a low of 32.3 on March 7. The average then rose slightly to 33.0 on March 11 to close out the session.

The next release of the ESI will be on Wednesday, March 26, 2025.