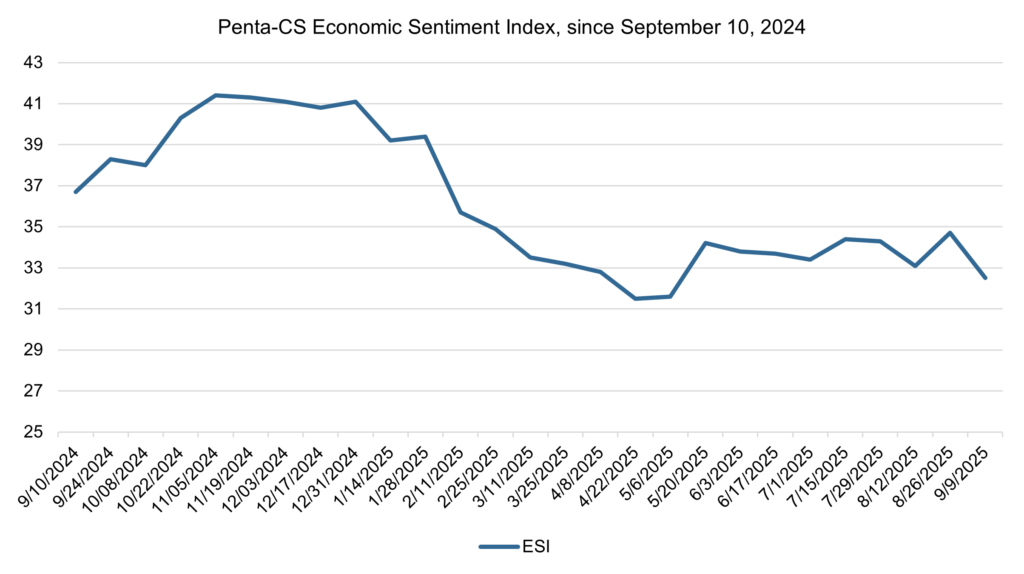

The latest biweekly reading of the Penta-CivicScience Economic Sentiment Index (ESI) fell sharply by 2.2 points, from 34.7 to 32.5, ahead of the September meeting of the Federal Open Markets Committee (FOMC).

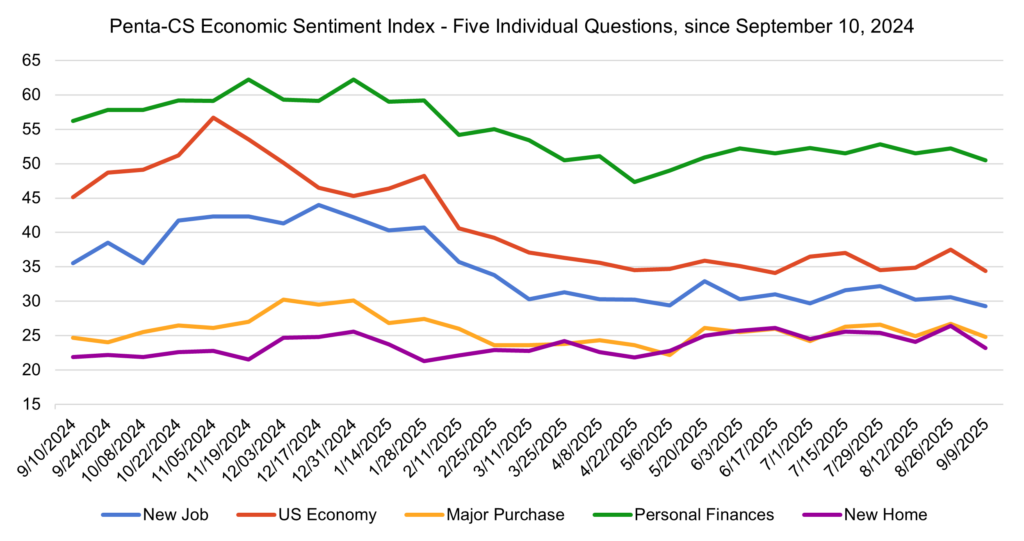

All five of the ESI’s indicators decreased during this period. Confidence in buying a new home decreased the most, declining 3.2 points to 23.2. This marks this indicator’s largest single-period loss in over a year.

—Confidence in the overall U.S. economy decreased 3.1 points to 34.4.

—Confidence in making a major purchase decreased 1.9 points to 24.8.

—Confidence in personal finances decreased 1.7 points to 50.5.

—Confidence in finding a new job decreased 1.3 points to 29.3.

The Commerce Department‘s latest personal consumption expenditures (PCE) price index showed that core inflation, which excludes volatile food and energy prices, rose 2.9 percent year-over-year, the highest annual rate since February. This increase to the Federal Reserve’s preferred inflation gauge was in-line with economists’ expectations.

The Bureau of Economic Analysis reported its second estimate of inflation-adjusted gross domestic product (GDP) for the second quarter of 2025, which showed that the U.S. economy grew at a 3.3 percent annualized rate. The increase in real GDP reflected a decrease in imports and an increase in consumer spending, partly offset by smaller decreases in exports and investment. This figure was revised up by 0.3 percentage points from the initial estimate, reflecting upward revisions to investment and consumer spending, smaller decreases in government spending, and increases in imports.

The August Jobs Report showed a marked slowdown in the U.S. labor market, with just 22,000 new jobs added—well below expectations and the weakest monthly gain since the depths of the pandemic. Revised data revealed a net job loss in June, the first since December 2020, while unemployment ticked up to 4.3 percent, its highest level in nearly four years. Hiring declines were broad-based, particularly in manufacturing, construction, and business services, with gains narrowly concentrated in healthcare and social assistance.

The Bureau of Labor Statistics‘ preliminary benchmark revision showed that new payroll growth in the year ending March 2025 was overstated by 911,000 jobs, potentially the largest downward revision on record. This adjustment cuts the previously reported average monthly job gains in half, suggesting the labor market was significantly weaker than believed and implying the slowdown seen in recent months began earlier than recognized. These data bolster expectations that the Federal Reserve will begin cutting interest rates at its next meeting, especially as Fed Chair Jerome Powell and other officials have already signaled concerns over rising labor market risks.

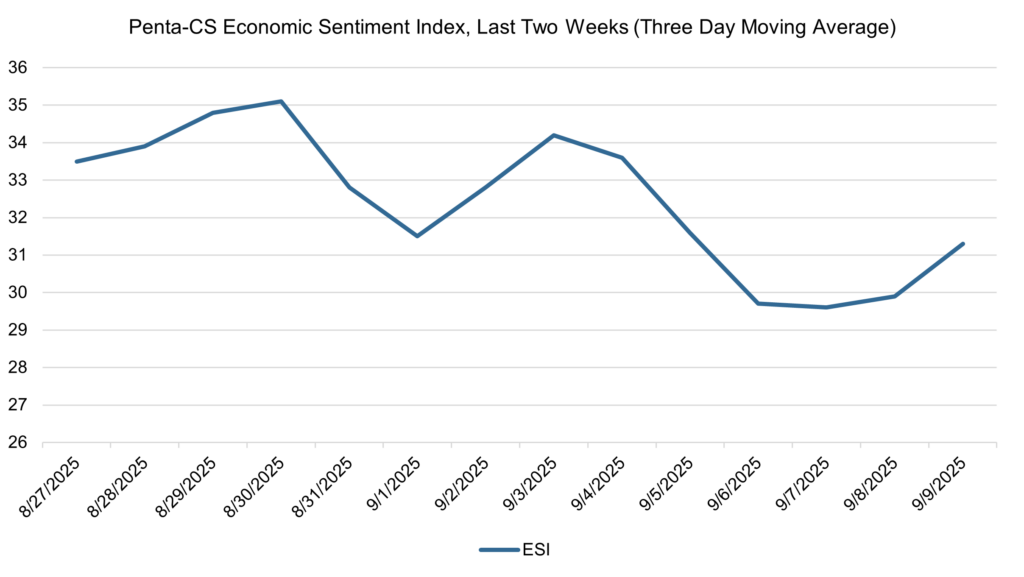

The ESI’s three-day moving average began this two-week stretch at 33.5 on August 27. It then increased to its peak of 35.1 on August 30. It then began to oscillate, falling and rising before declining again to hit a low of 29.6 on September 7. It then began to rise again to 31.3 on September 9 to close out the session.

The next release of the ESI will be on Wednesday, September 24, 2025.