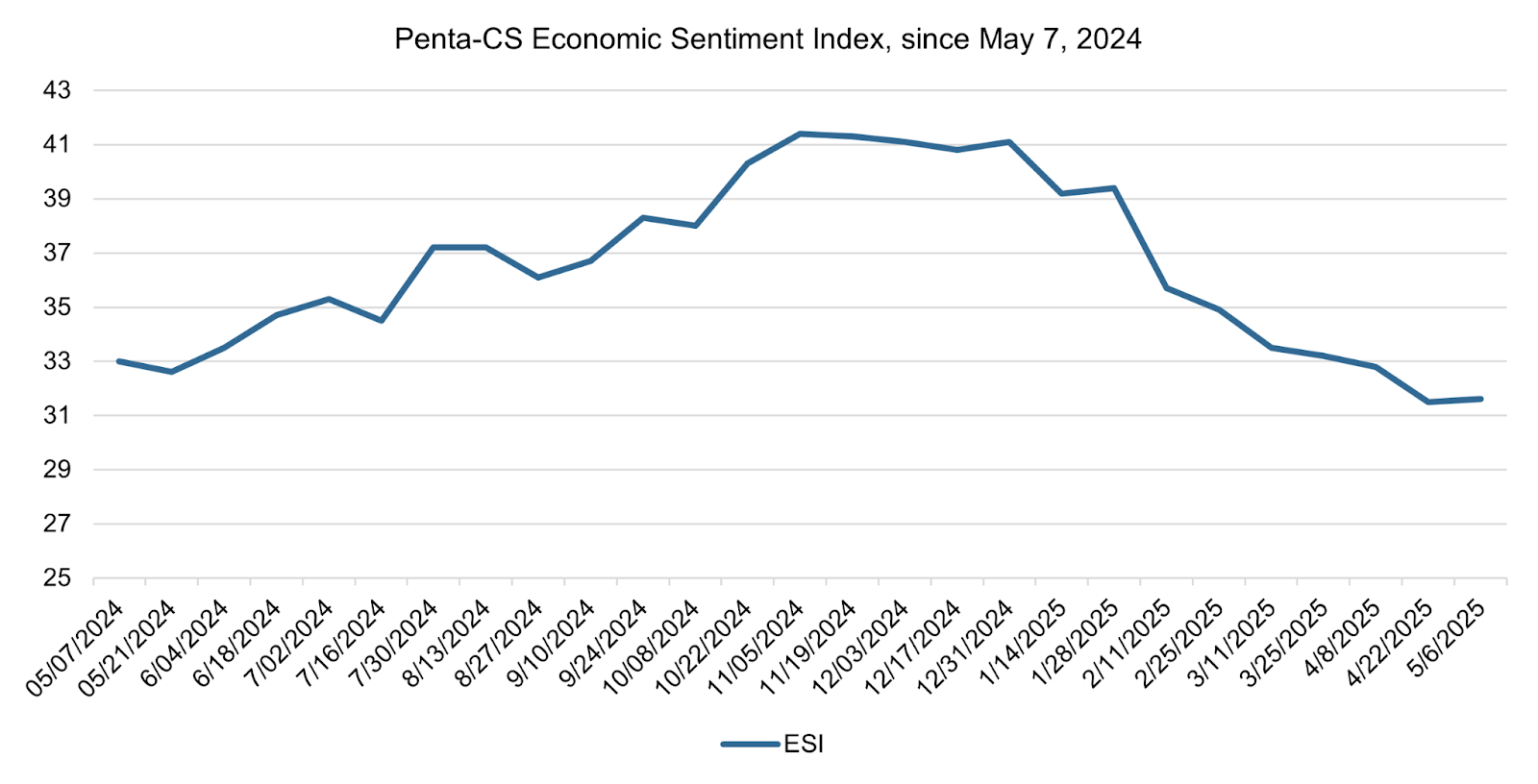

The latest biweekly reading of the Penta-CivicScience Economic Sentiment Index (ESI) increased by 0.1 points to 31.6, marking a respite from three months of consecutive declines in overall economic confidence.

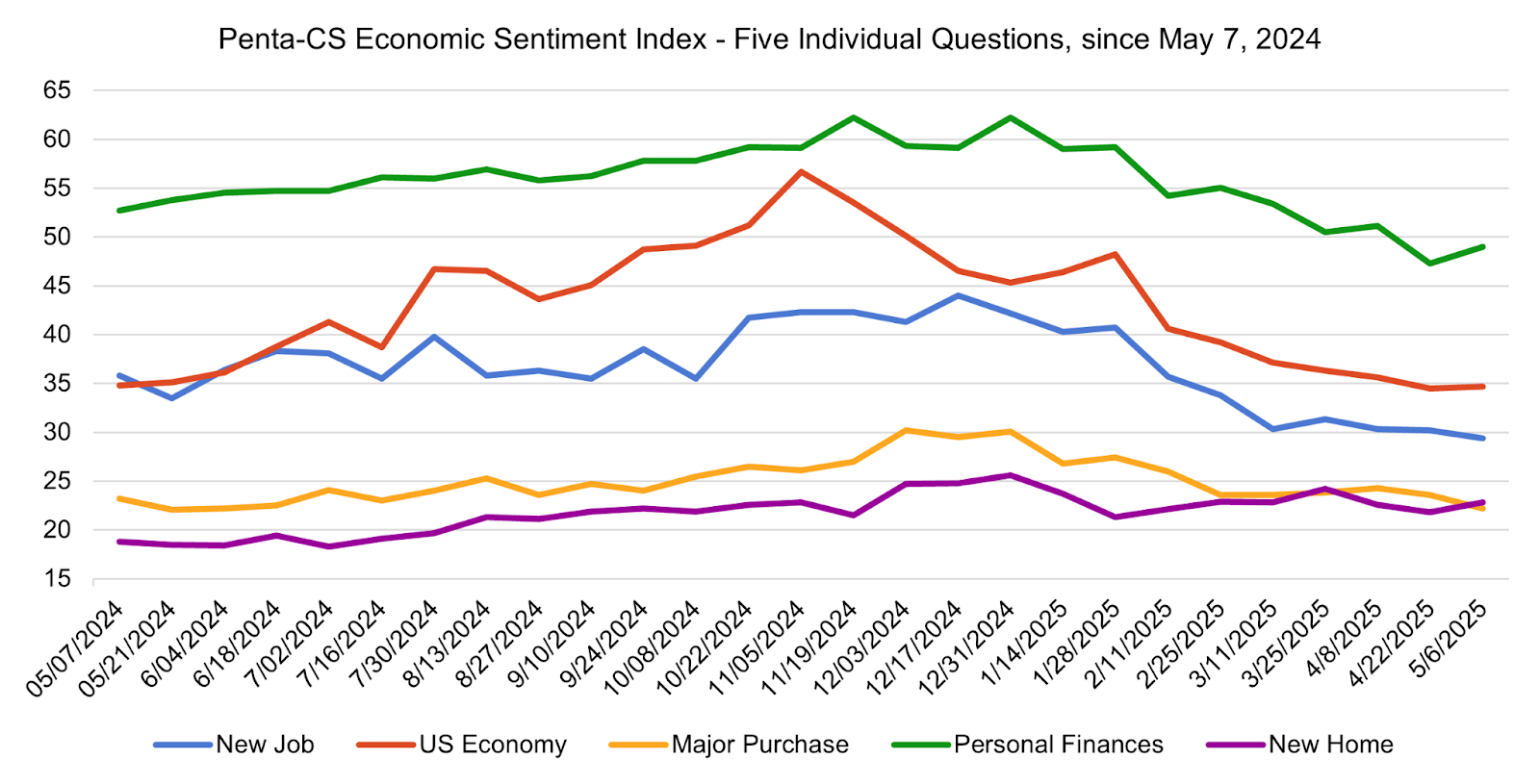

Three of the ESI’s five indicators increased during this period. Confidence in personal finances increased the most, rising 1.7 points to 49.0.

—Confidence in buying a new home increased 1.0 point to 22.8.

—Confidence in the overall U.S. economy increased 0.2 points to 34.7.

—Confidence in finding a new job decreased 0.8 points to 29.4.

—Confidence in making a major purchase decreased 1.4 points to 22.2.

The Commerce Department released its estimate of gross domestic product (GDP) for the first quarter of 2025, which showed that the U.S. economy contracted at an inflation-adjusted annual rate of 0.3 percent. This represents the first quarter that the economy has decelerated since 2022. The Commerce Department stated, “Compared to the fourth quarter, the downturn in real GDP in the first quarter reflected an upturn in imports, a deceleration in consumer spending, and a downturn in government spending that were partly offset by upturns in investment and exports.” Imports during the first quarter of this year rocketed up 41 percent, likely in response to rising tariffs imposed by the U.S. and retaliatory tariffs from abroad. However, imports do not negatively impact GDP, which is a measure of domestic economic production. Instead, according to an analysis by The Economist, the decline in GDP likely reflects measurement errors as well as households and firms replacing domestic consumption and investment with imports in order to front-load spending to avoid rising tariffs.

The April Jobs Report showed that the economy added 177,000 jobs last month while the unemployment rate remained unchanged at 4.2 percent. These gains were well above the 133,000 jobs predicted by economists polled by the Wall Street Journal and reflected increases across health care, transportation and warehousing, financial activities, and social assistance.

Additionally, the Commerce Department released the March personal consumption expenditures (PCE) price index which showed that inflation, excluding volatile food and energy prices, increased less than 0.1 percent from February to March and 2.6 percent year-over-year. This represents a deceleration from February, where core PCE increased 2.8 percent year-over-year. Meanwhile, consumer spending increased 0.7 percent from February.

Buoyed by strong jobs numbers, slowing inflation, and the prospect of new trade deals following President Donald Trump’s decision to pause his “retaliatory” tariffs, last week the stock market fully recovered the losses it endured in April amid volatility in U.S. tariff policies. Jeffrey Roach, chief economist at LPL Financial, told The New York Times, “If the labor market holds up and the Trump administration walks back the most egregious tariffs, the economy could skirt a deep recession.”

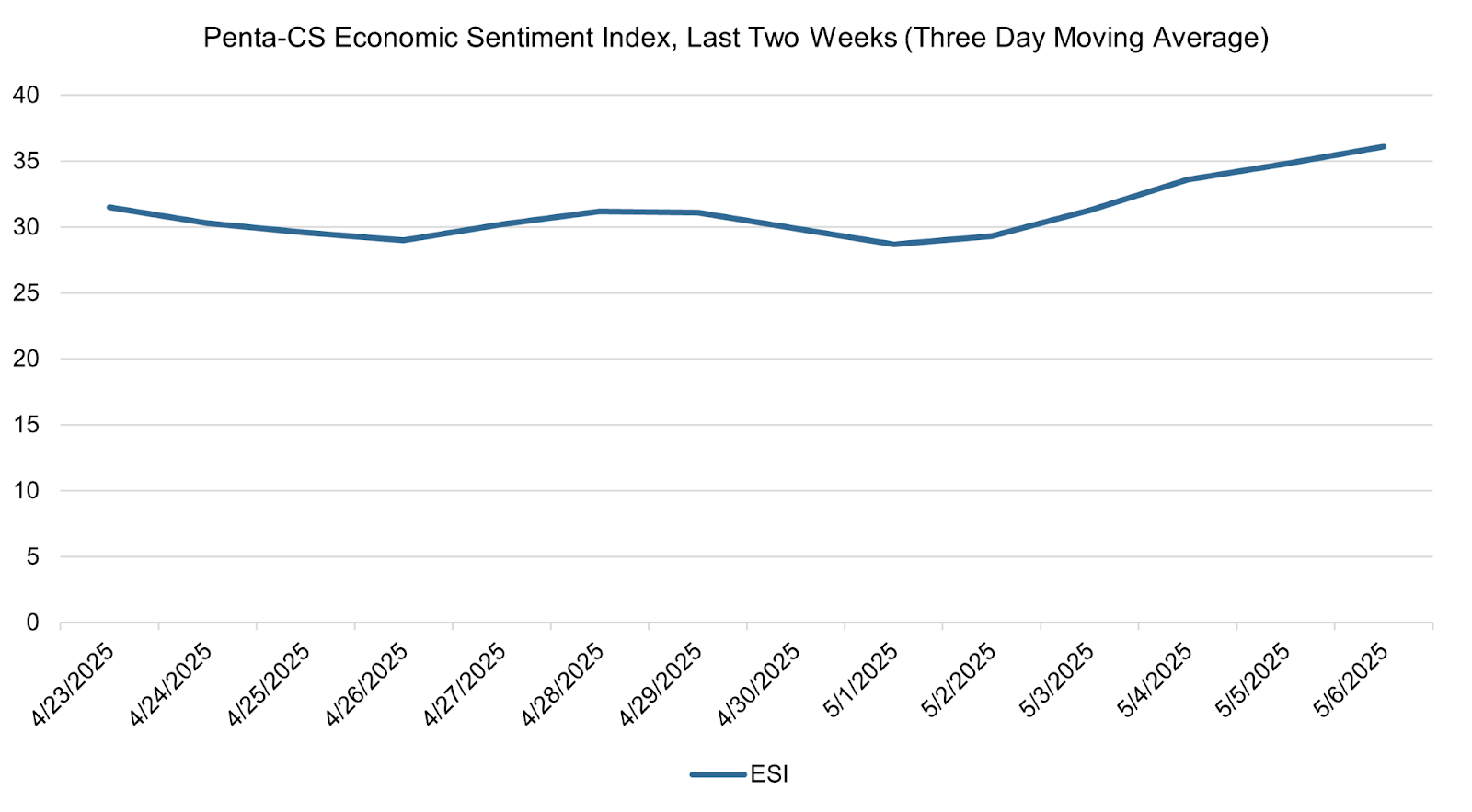

The ESI’s three-day moving average began this two-week stretch at 31.5 on April 23. It then trended downward to 29.0 on April 26 before rising to 31.2 on April 28. The three-day moving average then fell to a low of 28.7 on May 1 before rising to a high of 36.1 on May 6 to close out the session.

The next release of the ESI will be on Wednesday, May 21, 2025.