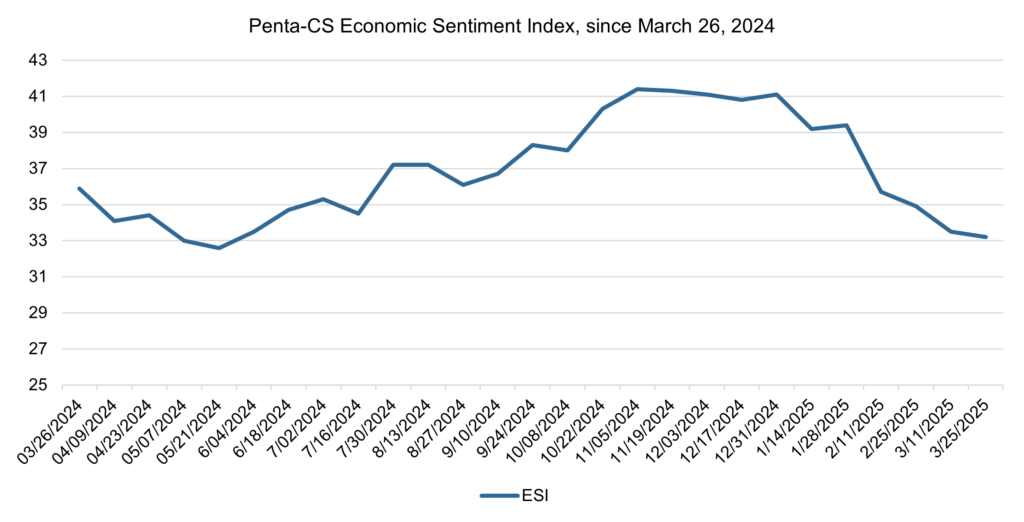

The latest biweekly reading of the Penta-CivicScience Economic Sentiment Index (ESI) fell by 0.3 points to 33.2. This marks the ESI’s fourth consecutive period of decline.

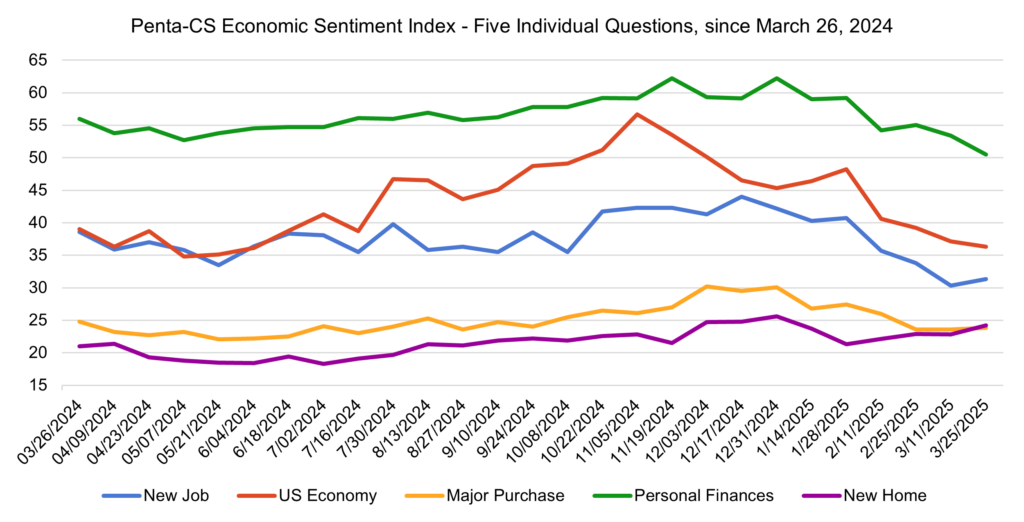

Two of the ESI’s five indicators decreased during this two-week period. Confidence in personal finances decreased the most, falling 2.9 points to 50.5.

—Confidence in the overall U.S. economy decreased 0.8 points to 36.3.

—Confidence in making a major purchase increased 0.2 points to 23.8.

—Confidence in finding a new job increased 1.0 point to 31.3.

—Confidence in buying a new home increased 1.4 points to 24.2

The Federal Reserve held interest rates steady within the range of 4.25 to 4.5 percent for a second straight meeting. In its statement, the Federal Open Markets Committee (FOMC) said, “Uncertainty around the economic outlook has increased.” Fed Chair Jerome Powell echoed this, saying that likely due to tariffs, “further progress may be delayed” on returning inflation to the Fed’s 2 percent target. FOMC members also raised their forecasts for core inflation this year while also predicting lower economic growth. Nevertheless, Fed officials continued to predict two rate cuts of 25 basis points each for this year.

The February Consumer Price Index (CPI) showed a lower-than-expected inflation rate of 2.8 percent. Both the overall CPI and the core CPI, which excludes volatile food and energy prices, increased by 0.2 percent for the month, falling slightly below economists’ forecasts. This moderation in price increases, particularly in shelter costs, suggests a positive trend in controlling inflation. However, uncertainties surrounding tariffs and their potential impact on prices remain a key concern.

The U.S. Census Bureau reported that retail sales rose just 0.2 percent in February, falling below the estimated 0.6 percent rise in sales projected by economists polled by The Wall Street Journal. January retail sales were also revised downward to a decline of 1.2 percent, the largest decline in monthly sales since 2021. Declining sales at department stores and bars and restaurants may indicate that consumers are cutting back on nice-to-have spending amidst broader economic uncertainty in the U.S.

On March 12, the European Union announced that retaliatory tariffs on U.S. goods would take effect on April 1. These tariffs are set to impact goods produced in Republican-leaning states, including Kentucky bourbon, agricultural products, jeans, and Harley-Davidson motorcycles. In response, President Donald Trump threatened a 200 percent tariff on wine and liquor from the EU. The EU’s tariffs were later delayed to mid-April with a European Commission spokesperson telling CNN that the delay was to ensure, “additional time for discussions with the U.S. administration.”

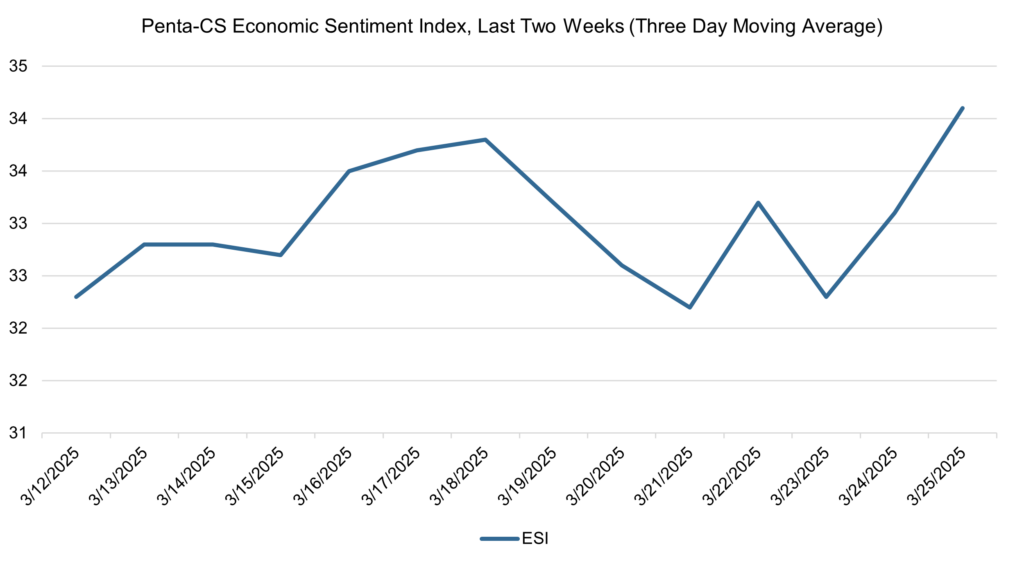

The ESI’s three-day moving average began this two-week stretch at 32.3 on March 12. It then rose consistently, hitting 33.8 on March 18 before trending downward to a low of 32.2 on March 21. The three-day moving average then rose and fell before rising again to a high of 34.1 on March 25 to close out the session.

The next release of the ESI will be on Wednesday, April 9, 2025.