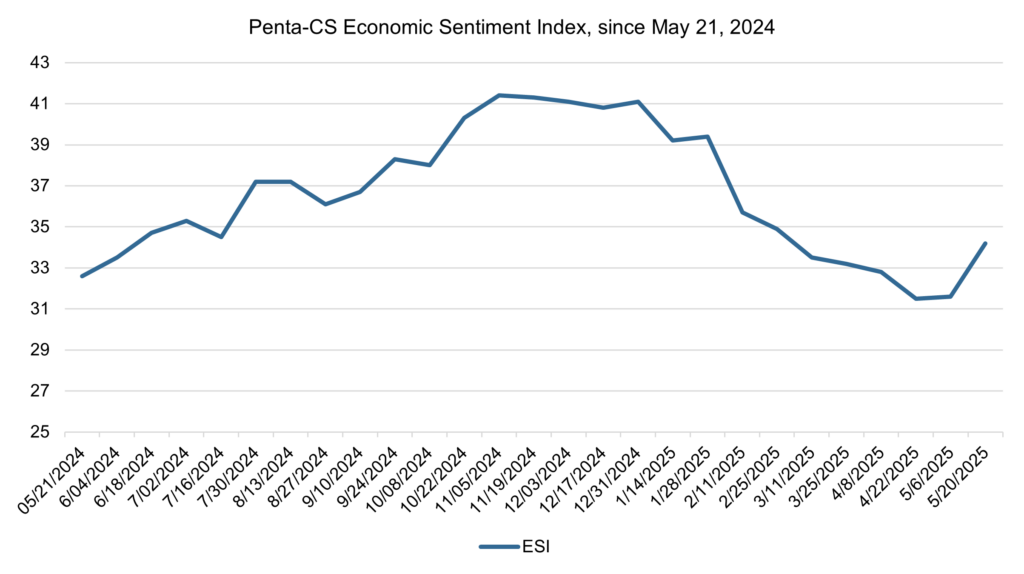

The Penta-CivicScience Economic Sentiment Index (ESI) posted its largest single-period increase since July 2024, rising 2.6 points to 34.2. This rebound comes after the United States and China agreed to a 90-day pause in additional tariffs, helping to reverse some of the ESI's steady declines seen since the new year and return the index to levels close to those in late February 2025.

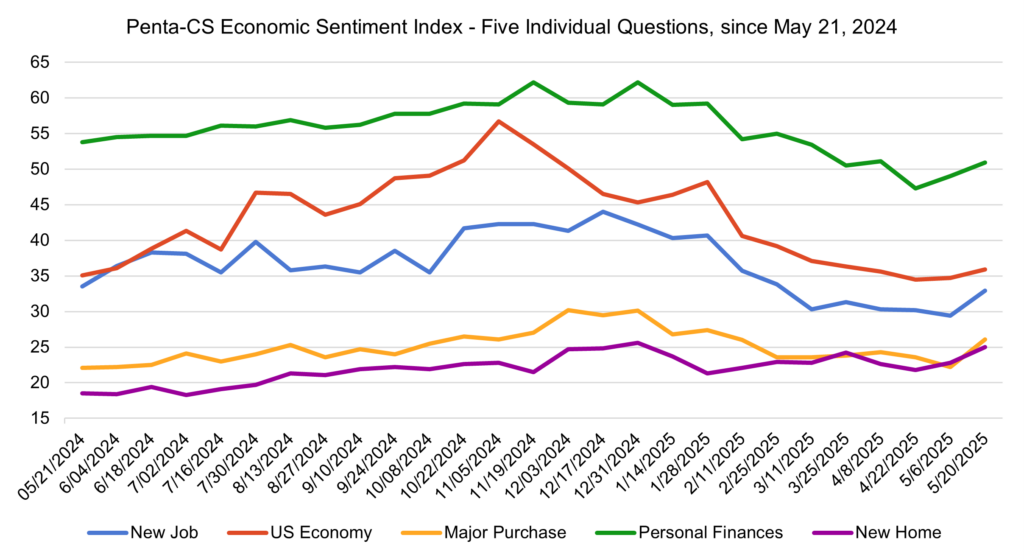

All five of the ESI’s indicators increased during this period. Confidence in making a major purchase increased the most, rising 3.9 points to 26.1.

All five of the ESI’s indicators increased during this period. Confidence in making a major purchase increased the most, rising 3.9 points to 26.1.—Confidence in finding a new job increased 3.5 points to 32.9.

—Confidence in buying a new home increased 2.2 points to 25.0.

—Confidence in personal finances increased 1.9 points to 50.9.

—Confidence in the overall U.S. economy increased 1.2 points to 35.9.

On May 7, the Federal Reserve left interest rates unchanged at between 4.25 and 4.5 percent. In its statement, the Federal Open Markets Committee reiterated its commitment to lowering inflation and maximizing employment but stated that “Uncertainty about the economic outlook has increased further. The Committee is attentive to the risks to both sides of its dual mandate and judges that the risks of higher unemployment and higher inflation have risen.” Fed Chair Jerome Powell echoed this statement in a news conference, warning that “If the large increases in tariffs that have been announced are sustained, they’re likely to generate a rise in inflation, a slowdown in economic growth, and an increase in unemployment.”

Later, on May 12, the White House and China announced a trade agreement that effectively paused the ongoing trade war, surprising markets with deeper-than-expected tariff reductions. China lowered its tariffs on U.S. goods to 10 percent, while the U.S. set its tariffs on Chinese imports at 30 percent. The U.S. rate includes a reciprocal 10 percent to match China’s, plus an additional 20 percent levy tied to China’s alleged involvement in the U.S. fentanyl crisis. The announcement also included news that the two countries would continue talks over the following 90 days with the goal of achieving a longer-term deal. Stock markets rallied upon the news with the Nasdaq Composite rising 4.3 percent that day and the S&P 500 jumping 3.3 percent.

However, five days later on May 16, Moody’s downgraded the U.S.’ credit rating from “Aaa” to “Aa1,” the last of the major credit rating agencies to downgrade the U.S. from the highest possible credit rating. Moody’s stated that, “Successive US administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest costs” and that “The US’ fiscal performance is likely to deteriorate relative to its own past and compared to other highly-rated sovereigns.”

The April Consumer Price Index (CPI) report showed that inflation increased 0.2 percent month-over-month while year-over-year inflation rose 2.3 percent, cooling slightly after rising 2.4 percent in the twelve months ending in March. This marks the CPI’s lowest annual increase since February 2021 and came in below economists’ expectations of 2.4 percent. Housing prices continued to be the driving force behind inflation as shelter prices rose 0.3 percent in April, accounting for more than half of the overall increase in the CPI.

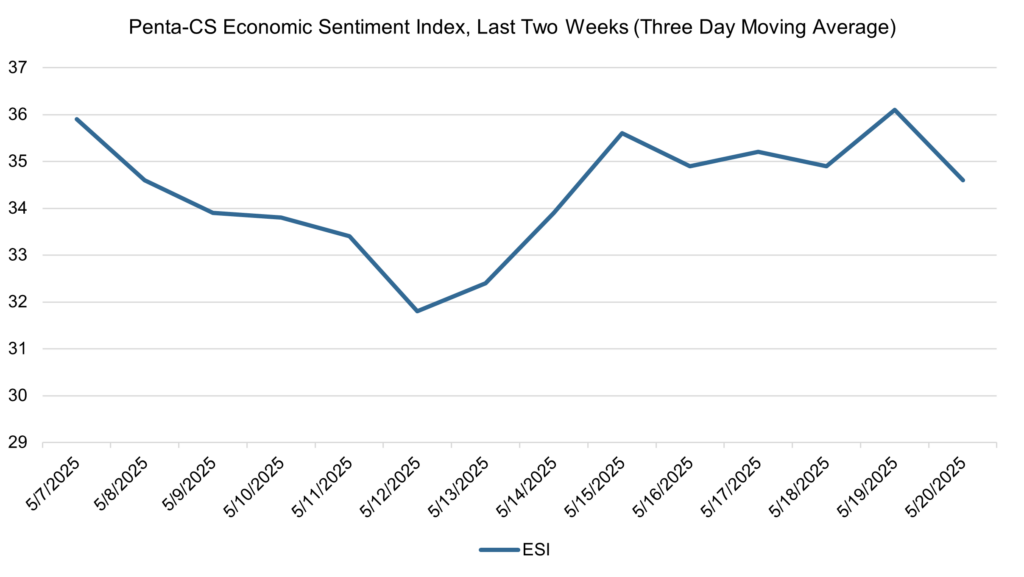

The ESI’s three-day moving average began this two-week stretch at 35.9 on May 7. It then decreased to a low of 31.8 on May 12 before rising rapidly following the U.S.-China trade deal announcement, hitting 35.6 on May 15. The three-day moving average then oscillated before hitting a high of 36.1 on May 19 and then declining to 34.6 on May 20 to close out the session.

The next release of the ESI will be on Wednesday, June 4, 2025.