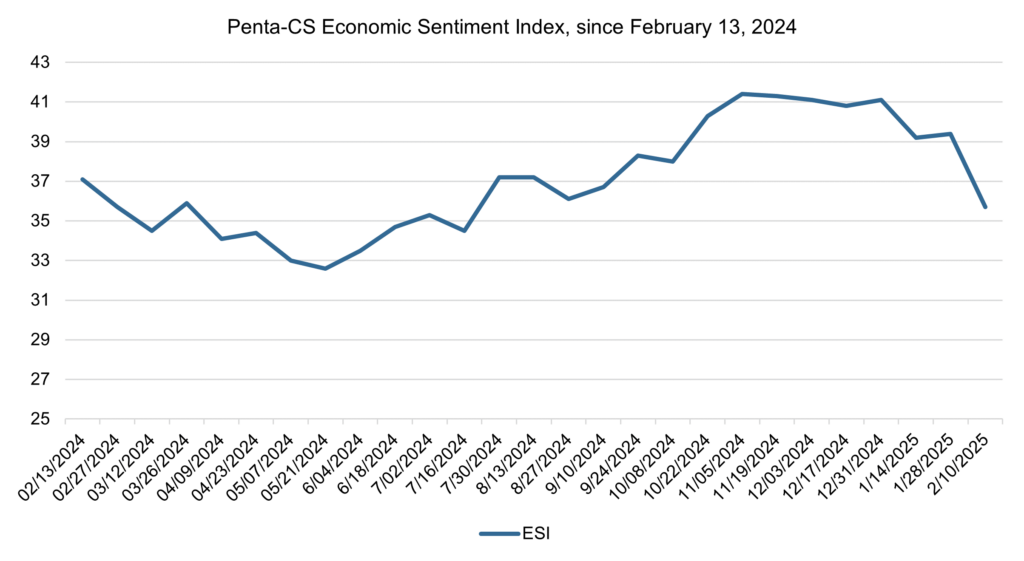

Following a slight increase last period, the Penta-CivicScience Economic Sentiment Index (ESI) fell by 3.7 points to 35.7, propelled by a major decline in confidence in the U.S. economy. This represents the ESI’s largest decrease in over a year.

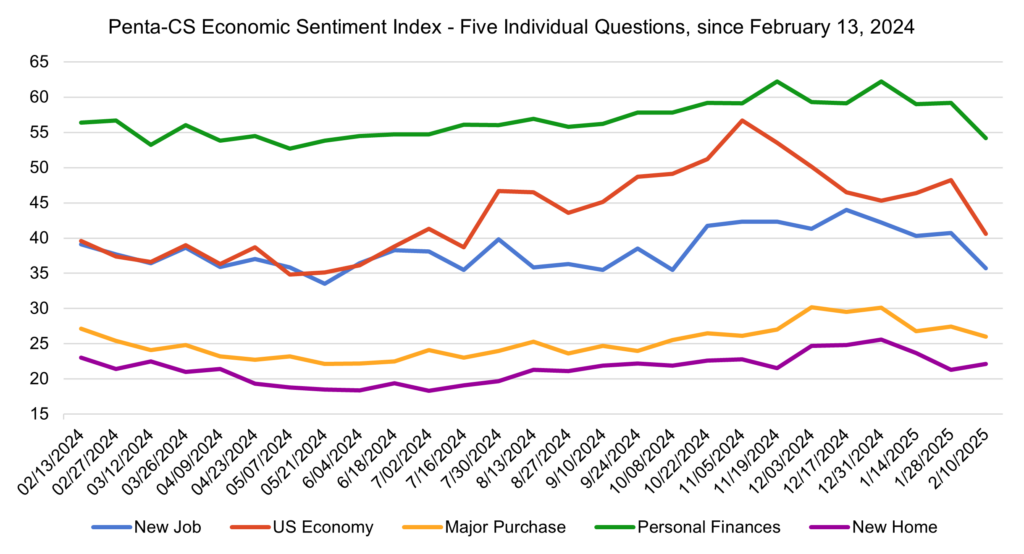

Four of the ESI’s five indicators decreased during this two-week period. Confidence in the overall U.S. economy decreased the most, falling 7.6 points to 40.6. This represents this indicator’s largest, single period decline since November 2020.

—Confidence in finding a new job decreased 5.0 points to 45.7.

—Confidence in personal finances decreased 5.0 points to 54.2.

—Confidence in making a major purchase decreased 1.4 points to 26.0.

—Confidence in buying a new home increased 0.8 points to 22.1.

The advance estimate of fourth-quarter GDP released by the Commerce Department shows the U.S. economy grew by 2.3 percent from October to December 2024, driven by both consumer and government spending. This represents slower growth than in the third quarter of 2024, when the economy expanded by 3.1 percent, and it fell short of the 2.5 percent increase projected by economists polled by Dow Jones.

The January jobs report showed an increase of 143,000 jobs, falling short of economists’ projections of 167,000 and significantly lower than the upwardly revised 307,000 jobs added in December. Meanwhile, the unemployment rate edged down to 4.0 percent from 4.1 percent in the previous month. According to the Bureau of Labor Statistics, job growth was driven by gains in healthcare, retail trade, and social assistance. Government employment also saw gains, adding 32,000 jobs in January. These gains came before at least 65,000 federal workers accepted the Office of Personnel Management’s recent ‘Fork in the Road’ email offer to leave their positions while continuing to receive pay and benefits through late September. Economists are questioning the impact that these resignations will have on the national labor market. Additionally, the legal status of the deferred resignation program remains uncertain after a federal judge in Massachusetts indefinitely delayed the deadline for federal employees to resign.

President Donald Trump signed two proclamations imposing 25 percent tariffs on both steel and aluminum. This move came after his decision to temporarily delay tariffs on Canada and Mexico, though both countries are expected to be impacted by the metal tariffs, as both countries rank among the top three suppliers of steel to the U.S., with Canada also being the largest aluminum exporter to the country. Trump defended the tariffs as a way to boost domestic production, stating, “Our nation requires steel and aluminum to be made in America, not in foreign lands…” However, experts have cautioned that the tariffs could drive up costs for consumers. President Trump also recently instituted a 10 percent tariff on all goods from China, on top of existing tariffs already in place, which led China to institute retaliatory tariffs of 10 to 15 percent on select U.S. exports, including fossil fuels, farm machinery, and large-engine cars.

Federal Reserve Chair Jerome Powell appeared before the Senate Banking Committee on February 11 and discussed the Fed’s ongoing efforts to bring inflation under control. Regarding future rate cuts, Powell said, “we think our policy rate is in a good place, and we don’t see any reason to be in a hurry to reduce it further.” Powell’s remarks came one day ahead of new inflation data which will likely influence the Fed’s approach to future rate decisions. The January Consumer Price Index (CPI) report showed that consumer prices increased 0.5 percent in January and have risen 3.0 percent annually. This represents the CPI’s largest month-over-month increase since September 2023. This inflation report was hotly anticipated as many businesses often choose the beginning of the year as the time to raise their prices to account for rising input costs.

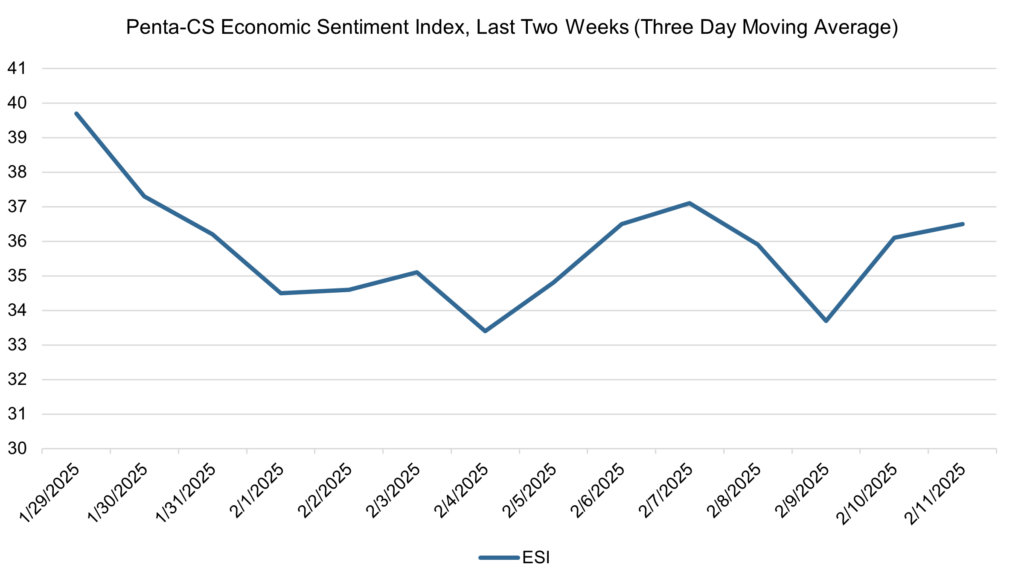

The ESI’s three-day moving average began this two-week stretch at a high of 39.7 on January 29. It then trended downward to 34.5 on February 1 and rose slightly before falling to a low of 33.4 on February 4. The three-day moving average then rose to 37.1 on February 7 and fell back down before rising to 36.5 on February 11 to close out the session.

The next release of the ESI will be on Wednesday, February 26, 2025.