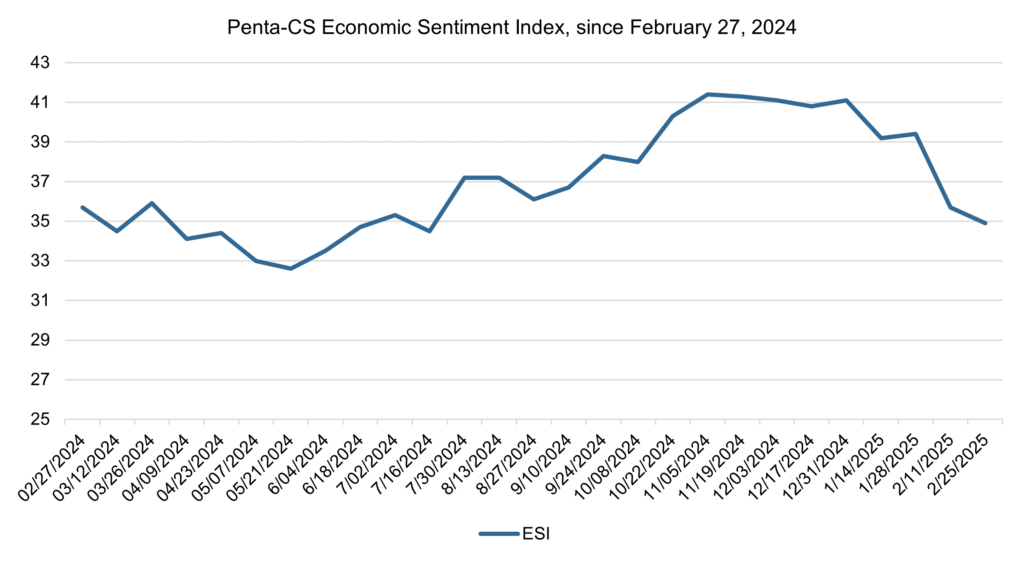

Following a substantial decline last period, the Penta-CivicScience Economic Sentiment Index (ESI) fell by 0.8 points to 34.9, furthering a notable decline in confidence in the U.S. economy in 2025.

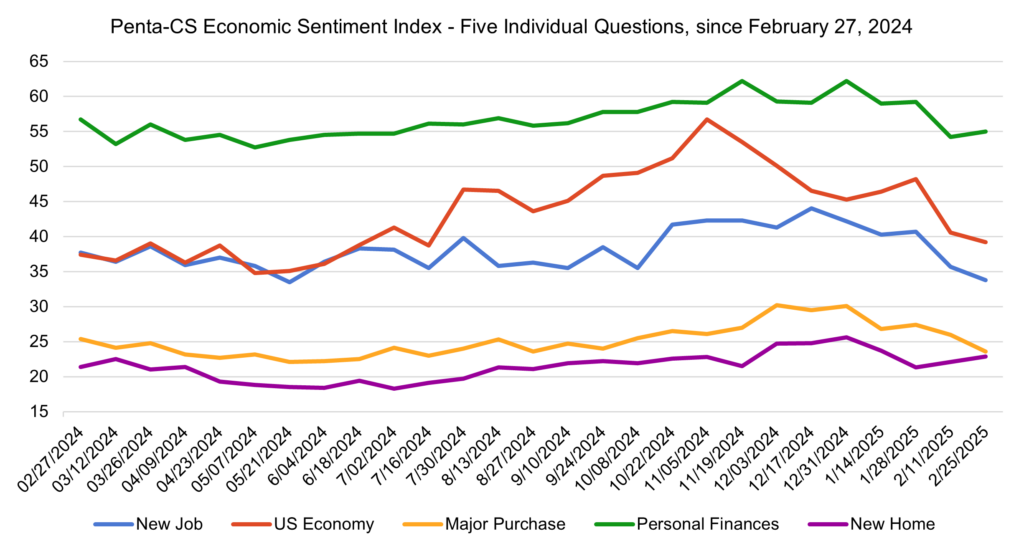

Three of the ESI’s five indicators decreased during this two-week period. Confidence in making a major purchase decreased the most, falling 2.4 points to 23.6.

—Confidence in finding a new job decreased 1.9 points to 33.8.

—Confidence in the overall U.S. economy decreased 1.4 points to 39.2.

—Confidence in personal finances increased 0.8 points to 55.0.

—Confidence in buying a new home increased 0.8 points to 22.9.

The Chicago Fed National Activity Index (CFNAI), which gauges economic activity and inflationary pressure, decreased to -0.03 in January, down from +0.18 in December. In January, employment-related indicators saw gains, whereas production-related and personal consumption and housing indicators declined compared to December. Meanwhile, the CFNAI’s three-month moving average increased to +0.03 in January from -0.13 in December.

Data from the National Association of Realtors (NAR) show that existing home sales fell 4.9 percent in January compared to December, though year-over-year sales increased 2.0 percent. NAR Chief Economist Lawrence Yun stated, “Mortgage rates have refused to budge for several months despite multiple rounds of short-term interest rate cuts by the Federal Reserve” and that “When combined with elevated home prices, housing affordability remains a major challenge.” Meanwhile, total housing inventory increased 3.5 percent from December and 16.8 percent year-over-year. The Wall Street Journal reports that this supply of homes is shifting power to home buyers, with recent data from Redfin showing that the average U.S. home is selling for 1.8 percent below the asking price.

President Donald Trump signed a presidential memorandum directing his administration to develop a “fair and reciprocal plan” for international trade. The directive calls for the creation of a plan to increase U.S. tariffs in response to other countries’ trade barriers and other policies including tariffs, subsidies for domestic industries, exchange rates, and value-added taxes. The Trump Administration later announced additional tariffs of around 25 percent on imports of automobiles, pharmaceuticals, and semiconductors.

The U.S. Census Bureau reported that retail sales fell drastically in January, decreasing by 0.9 percent from the previous month. This represents this indicator’s largest month-to-month drop in nearly two years. However, Robert Frick, corporate economist at Navy Federal Credit Union told Reuters, “The drop was dramatic, but several mitigating factors show there’s no cause for alarm.” These factors included a large upward revision to 0.7 percent from 0.4 percent for December, as well as seasonal fluctuations that often occur at the beginning of the year.

The stock market also posted large declines following declining consumer sentiment and ongoing fears about a trade war. The S&P 500 fell by 1.7 percent last week and the Nasdaq Composite declined by over 2 percent. These fears are amplified by investor concerns about the Federal Reserve’s monetary policy. The Fed has signaled that further rate cuts are not expected given inflation remains stubbornly above the Fed’s 2 percent target.

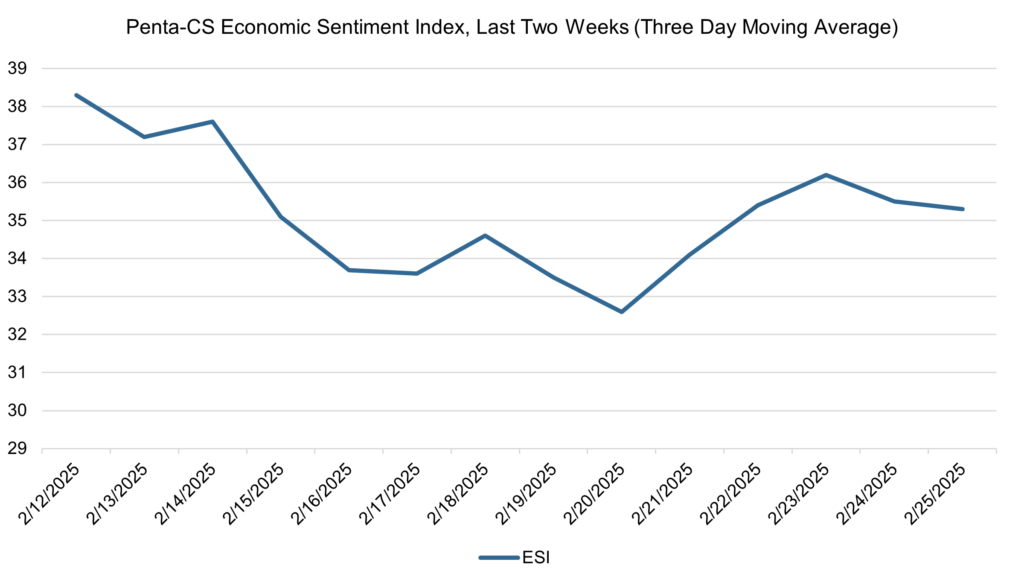

The ESI’s three-day moving average began this two-week stretch at a high of 38.3 on February 12. It then oscillated, trending downward before reaching a low of 32.6 on February 20. The three-day moving average then rose back up to 36.2 on February 23 before falling to 35.3 on February 25 to close out the session.

The next release of the ESI will be on Wednesday, March 12, 2025.