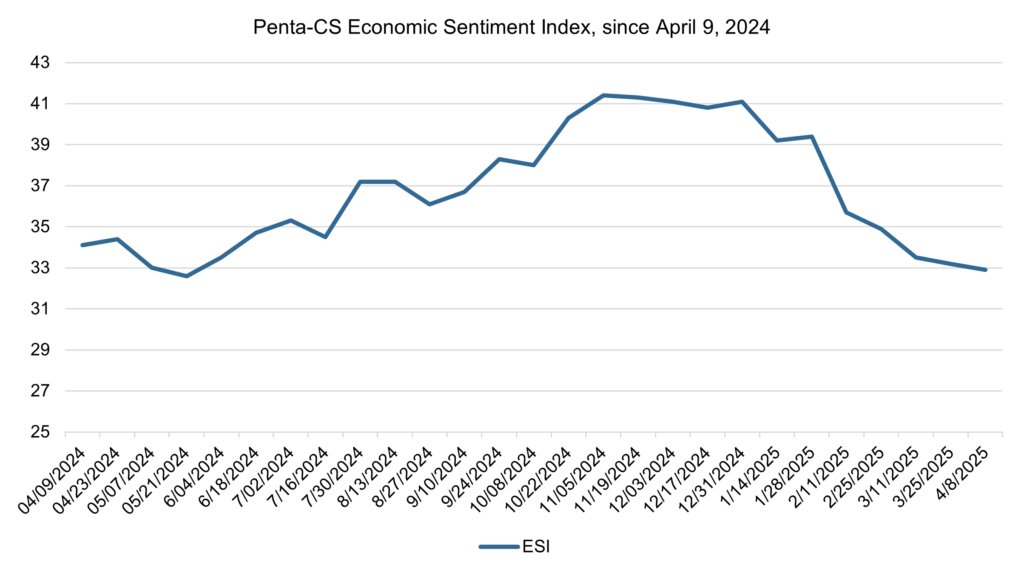

The Penta-CivicScience Economic Sentiment Index (ESI) decreased 0.3 points to 32.9, during a two-week stretch dominated by news coverage of President Donald Trump’s worldwide, “reciprocal tariffs."

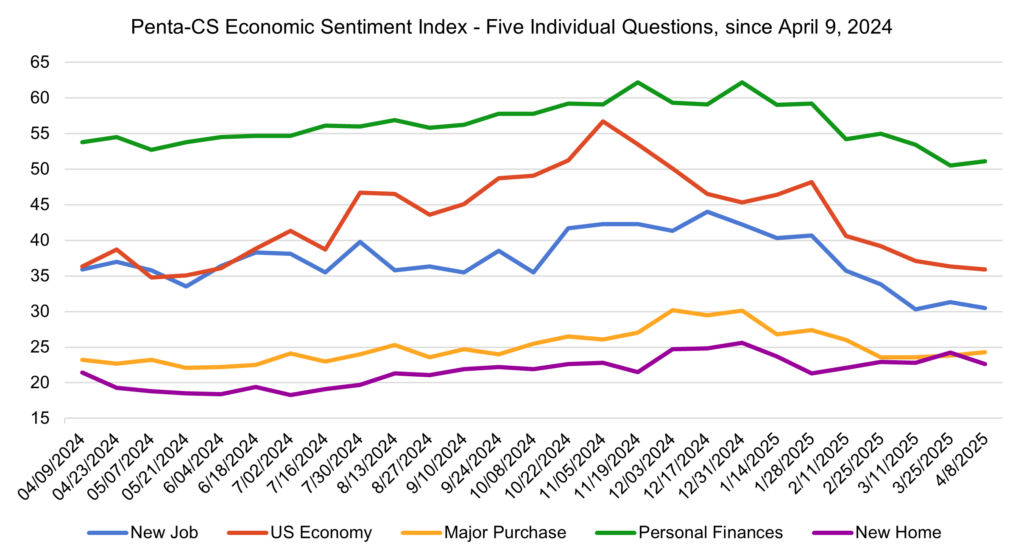

Three of the ESI’s five indicators decreased during this two-week period. Confidence in buying a new home decreased the most, falling 1.6 points to 22.6.

—Confidence in finding a new job decreased 0.8 points to 30.5.

—Confidence in the overall U.S. economy decreased 0.4 points to 35.9.

—Confidence in making a major purchase increased 0.5 points to 24.3.

—Confidence in personal finances increased 0.6 points to 51.1.

The news cycle over the past two weeks has paid extraordinary attention to tariffs and fears of a global trade war. On March 26, President Trump announced a 25 percent tariff on imported cars and car parts. The White House claimed that this move will strengthen U.S. manufacturing, though analysts at Morgan Stanley estimate that this tariff could raise the average car price for consumers by $6,000.

On April 2, President Trump declared “Liberation Day” for U.S. trade policy as he announced a 10 percent tariff on imports from all countries into the U.S. with additional sanctions on countries that have large trade deficits or other purported trade distortions with the U.S. Notably, goods from the European Union will face a 20 percent tariff and imports from China will face an additional 34 percent tariff. President Trump justified the tariffs, stating that “If you want your tariff rate to be zero then you build your product right here in America.”

Following Trump’s “Liberation Day” announcement, many countries have signaled that they will impose retaliatory tariffs on the U.S. On April 4, China announced a 34 percent reciprocal tariff on the U.S., which led President Trump to threaten an additional 50 percent tariff against the country should it not withdraw its 34 percent reciprocal sanction. European Commission President Ursula von der Leyen offered a “zero-for-zero” tariff deal for industrial goods with the U.S. on April 7 to avoid a trade war. Von der Leyen stated, “We stand ready to negotiate with the U.S.” but also noted that retaliation is not out of the picture, stating, “We are also prepared to respond through countermeasures and defend our interests.”

The tariff news sent shockwaves through the economy. On Friday, April 4, the Dow Jones Industrial Average dropped 5.5 percent, and the S&P 500 closed 5.9 percent down. This marked the Dow’s largest decline since June 2020. Federal Reserve Chair Jerome Powell warned that new tariffs are “significantly larger than expected” and that, “The same is likely to be true of the economic effects, which will include higher inflation and slower growth.” This renewed economic uncertainty has reignited discussions about the possibility of a recession. Goldman Sachs raised its estimate of the likelihood that the U.S. will enter a recession in the next year to 35 percent, up from 20 percent. In contrast, the International Monetary Fund (IMF) expects a slowdown but does not anticipate a recession. IMF spokeswoman Julie Kozack stated that “Large policy shifts have been announced and the incoming data is signaling a slowdown in economic activity” but noted that, “[a] recession is not part of our baseline.”

In other economic news, the U.S. Bureau of Labor Statistics (BLS) released the March Jobs Report which showed that the labor market added 228,000 jobs in March, coming in well above economists’ predictions. Meanwhile, the unemployment rate ticked up 0.1 percentage points to 4.2 percent. BLS stated that this solid job growth can be attributed to gains in healthcare, social assistance, transportation and warehousing, and retail trade.

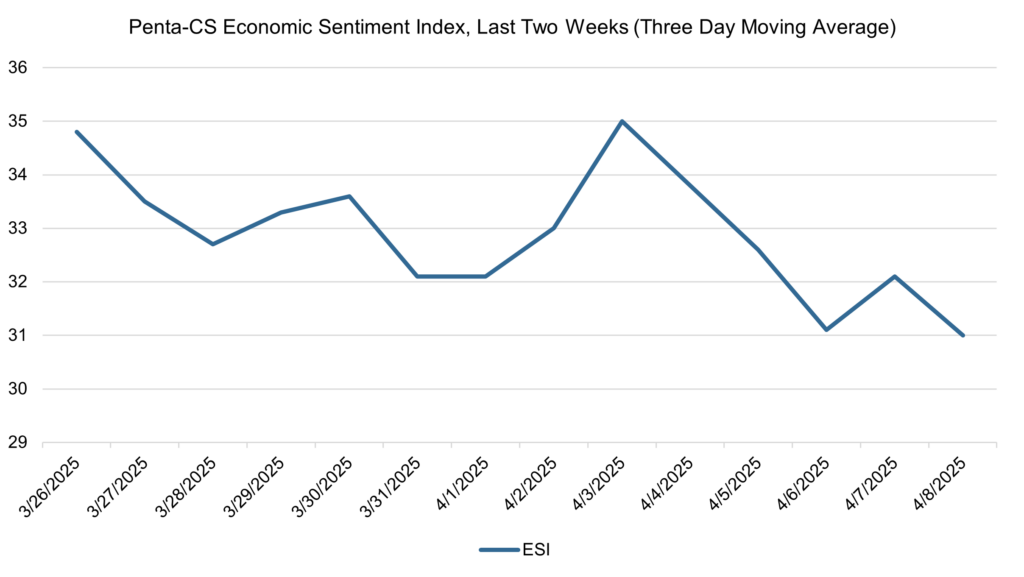

The ESI’s three-day moving average began this two-week stretch at 34.8 on March 26. It then oscillated between decreasing and increasing, flatlining at 32.1 on March 31 and April 1 before rising to a high of 35.0 on April 3. However, the three-day moving average then began declining precipitously in-line with the announcement of retaliatory tariffs by the U.S., hitting a low of 31.0 on April 8 to close out the session.

The next release of the ESI will be on Wednesday, April 23, 2025.